NVIDIA Corporation

In this article, I am explaining the chart analysis of the stock NVIDIA. Most of the machine users might know about this stock. NVIDIA Corporation (NASDAQ: NVDA) is a leading technology company known for its graphics processing units (GPUs) and contributions to the fields of gaming, professional visualization, data center, and automotive markets. This analysis will cover key aspects of NVIDIA’s stock, including recent performance.

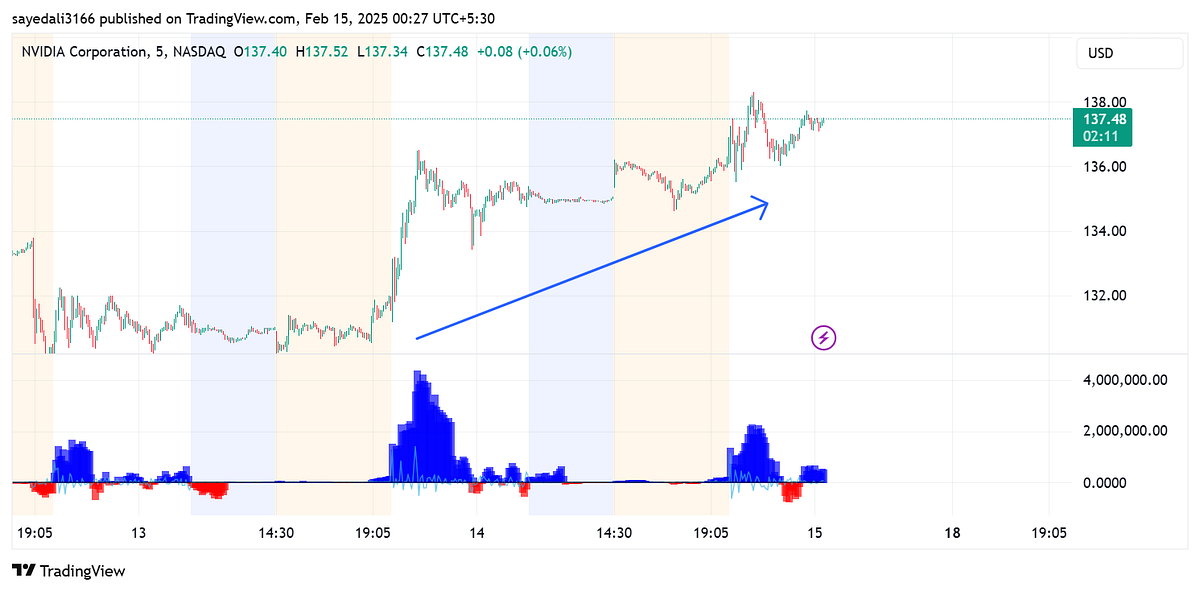

Recent Performance

As of now, the stock is trading at the price of 137. It is in an uptrend direction. And you can see the intraday volume (blue) is rising means it still flies further. More bull eyes mean more to fly. Let’s analyze it with Indicators.

After adding the CPR indicator, you can see the stock trading above the CPR which means it’s in the buy demand zone. The previous day’s CPR is below today’s CPR.

Growth Drivers

Gaming

- NVIDIA’s GPUs are widely used in gaming, a sector that continues to grow with the rise of eSports and virtual reality.

Data Centers

- The demand for data center solutions, particularly for AI and machine learning applications, is a significant growth driver for NVIDIA.

Automotive

- NVIDIA is making strides in the automotive sector with its autonomous driving technology and partnerships with major car manufacturers.

AI and Machine Learning

- NVIDIA’s GPUs are critical for AI and machine learning applications, positioning the company well in this rapidly growing field.

NVIDIA Corporation remains a strong player in the technology sector, with significant growth drivers in gaming, data centers, and AI. However, investors should be mindful of potential risks such as market competition and supply chain issues. Conducting thorough research and staying updated with the latest market trends is crucial for making informed investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

That was the high for 2025!