Are you tired of spending hours hunting for indicators that promise profits but only deliver confusion? Look no further. In this article, we’re diving into a beginner-friendly yet incredibly powerful TradingView strategy that blends three top-notch indicators into one clear, profitable setup.

Let’s break down how this strategy works, step by step, and why it’s quickly becoming a go-to for traders who want reliable buy/sell signals that actually make sense.

🚀 What Makes This Strategy Special?

This strategy is based on a unique indicator trio:

- 3Captain Indicator

- ENQ Oscillator

- Bank Funds Integration

Together, they form a tight, high-conviction strategy that filters out false signals and focuses only on clean, high-probability setups.

This isn’t just another noisy strategy — it clearly shows when to enter, where to place your stop loss, and what risk-to-reward ratio to target. All of this works with simple visual cues that even new traders can understand in minutes.

🛠 How to Set It Up in TradingView

Setting up this strategy is surprisingly easy. Here’s how:

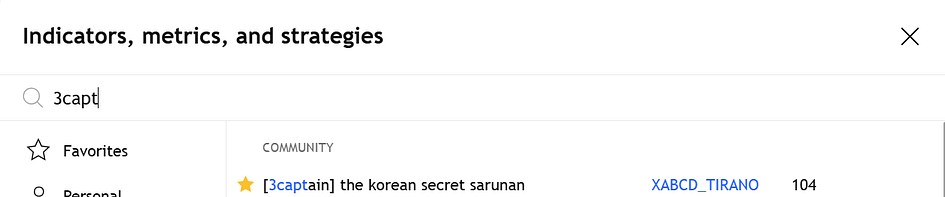

Step 1: Add the “3Captain” Indicator

- Go to TradingView.

- Open any security (stock, crypto, forex pair, etc.).

- In the indicators section, search for “Three Captain”.

- Choose the one labeled Korean Secret Suranin Option.

💡 Pro Tip: Hide the plot lines of this indicator for a cleaner chart.

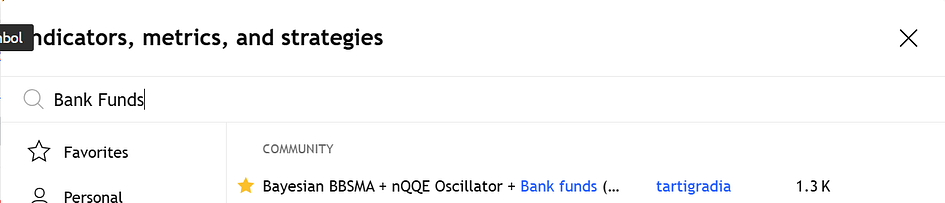

Step 2: Add the “Bank Funds” Combo Indicator

- Again, in the indicator section, search for “Bank Funds”.

- Select: Beijian BBSMA + ENQ Oscillator + Bank Funds.

Now your chart is ready.

This combo merges trend detection with institutional-level momentum tracking, helping you stay in sync with big-money moves.

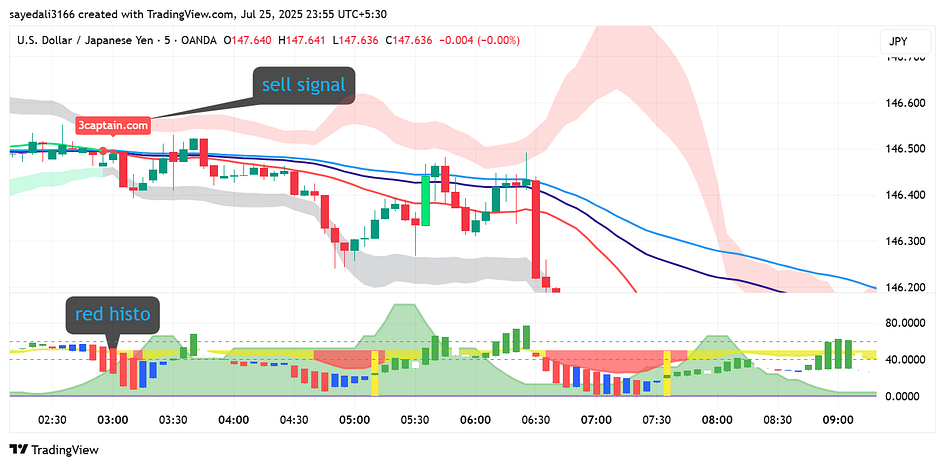

📉 Sell Entry Conditions (Short Setup)

Let’s break down how you would enter a Sell Trade:

✅ Three Captain shows “Sell Captain” signal

✅ Market forms a bearish candle (confirmation)

✅ ENQ Oscillator + Bank Funds bars turn bearish

🔁 If all these three conditions align, enter a SELL trade.

Stop Loss: Place it at the EMA line shown by the Three Captain Indicator.

Target: Risk-to-Reward ratio of 1:2.

🎁 Bonus: Want More Free Strategies?

I’ve compiled 25+ intraday strategies like this into one neat, downloadable eBook. All of them are:

- Tested

- Easy to follow

- Designed for real-world trading

All my ebooks are now available on Gumroad. For more trade info, check my website Tradetalkshub

1. Candlestick Indicators

2. CPR MASTER CLASS.

3.10 BUY & SELL CUSTOM INTRADAY INDICATORS IN 2025

4. OPTIONS AND FUTURES FOR BEGINNERS 2025

5. 15 INTRADAY TRADING INDICATORS

6. 25 Intraday Trading Strategies in 2025

7. STOCK MARKET FOR BEGINNERS

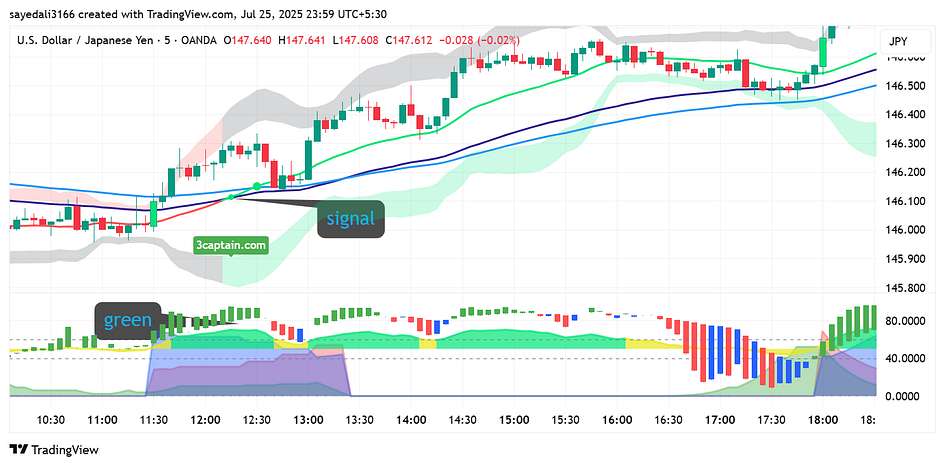

📈 Buy Entry Conditions (Long Setup)

To take a Buy Trade, you’ll look for the opposite:

✅ Three Captain shows “Buy Captain” signal

✅ Market forms a bullish candle (confirmation)

✅ ENQ Oscillator + Bank Funds bars turn bullish

🔁 Once again, wait for all three to align before you enter.

Stop Loss: Again, place it at the EMA line from the Three Captain indicator.

Target: Risk-to-Reward ratio of 1:2.

📉 What Happens When a Trade Fails?

Yes, you read that right — not every trade will win.

During the video walkthrough, one buy setup failed to reach the target. And that’s okay.

As the creator wisely said

“No strategy in the world has a 100% win rate. Losses are part of the game.”

That’s why risk management is crucial. With a 1:2 risk-reward ratio, even a 40% win rate can keep you profitable in the long run.

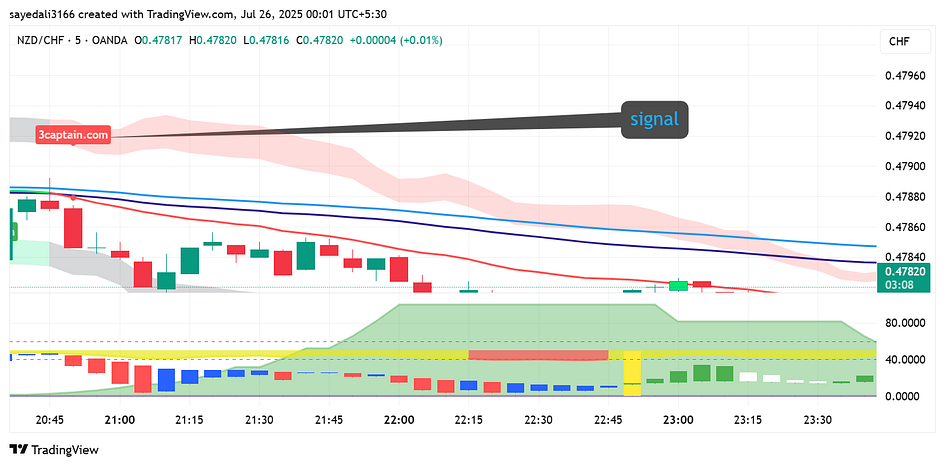

📊 Real Trade Examples (Tested on NZDCHF — 5M Chart)

This strategy was back-tested multiple times on the 5-minute chart of the NZDCHF forex pair, and here are some real results:

🟢 Buy Captain Signal → Bullish Candle → Bullish Oscillator → Target Hit

🔴 Sell Captain Signal → Bearish Candle → Bearish Oscillator → Target Hit

🟡 One loss was recorded, but the winning streak kept the account in healthy profit due to the 1:2 risk-reward ratio.

This pattern repeated consistently, confirming the reliability of this setup.

🧠 Why This Strategy Works So Well

✅ Three Captain = Clear Trend Detection

✅ Bank Funds = Institutional Movement Clue

✅ ENQ Oscillator = Momentum Confirmation

When combined, these indicators cut through market noise, giving you confirmation-based entries rather than impulsive guesses.

It’s rule-based, visual, and applicable across multiple timeframes and assets. That’s a rare trifecta in the world of technical analysis.

🧰 Ideal for:

- 🟢 Beginners who want clean, reliable setups

- 🔁 Intraday and scalping traders who rely on quick decisions

- 📊 Swing traders looking for confirmation-based entries

- 📉 Forex, stocks, crypto, or futures traders

⚠️ Risk Reminder

Even though this strategy looks solid, always remember:

“Trading is risky. No indicator can guarantee profits.”

Before you use this strategy live:

- Test it on paper trading

- Understand the rules and signals

- Use proper position sizing

- Avoid overtrading

🧾 Final Thoughts

This 3-Captain + Bank Funds Strategy is a goldmine for traders who want structured entries and clean charts. It’s simple, rule-based, and proven through examples — making it one of the best free strategies you can try right now on TradingView.

If you’ve been stuck trying random indicators or chasing social media hype, give this a try. It could be the clarity your trading routine has been missing.