Most traders overload their charts with 10–20 indicators, dozens of signals, and endless “holy grail” experiments. But what if a high-accuracy setup needed only two indicators on a 5-minute chart?

That’s exactly what this new strategy delivers.

I tested it for a few days—tracking every signal, refining rules, and watching how price reacted.

The accuracy shocked me.

Here’s a clean, step-by-step breakdown you can start using immediately.

The Core Concept

This strategy is built on just two tools:

- Log Pressure Envelope → Generates Buy/Sell arrows

- Dimbeta Moving Average Oscillator (DIMMA) → Confirms trend direction

When these two align with candle direction, you get a high-probability scalping system for the 3–5 minute timeframe.

Think of it like this:

- Log Pressure = Signal

- DIMMA = Trend Confirmation

- Candle = Entry Trigger

It’s clean. It’s visual. And it’s extremely beginner-friendly.

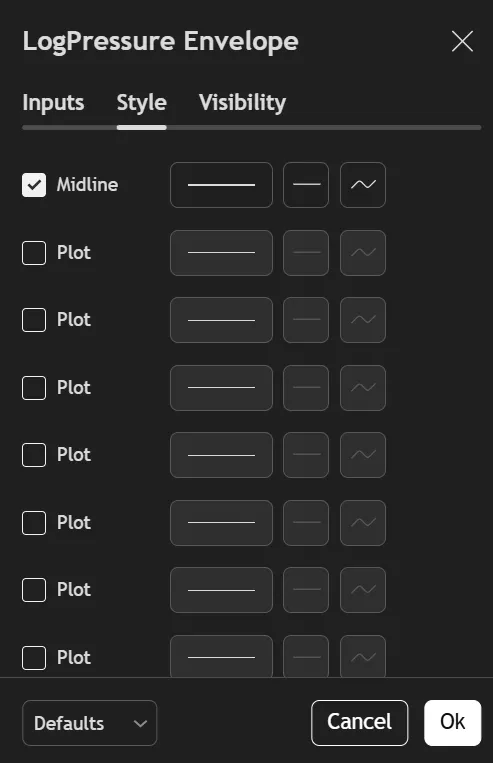

Indicator 1: Log Pressure Envelope (Entry Signal)

This indicator builds a dynamic envelope around price and prints BUY (↑) and SELL (↓) arrows whenever pressure imbalances appear.

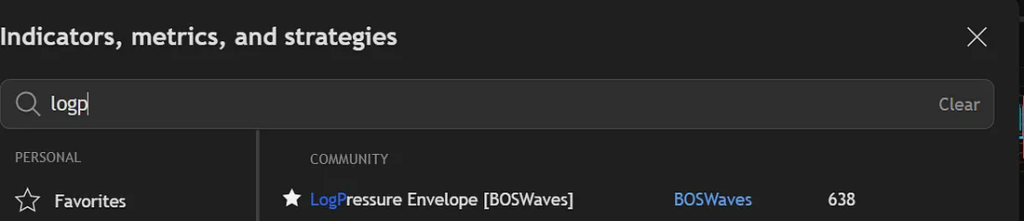

How to Add on TradingView

- Open TradingView

- Go to Indicators

- Search: Log Pressure Envelope Trail

- Add it to your chart

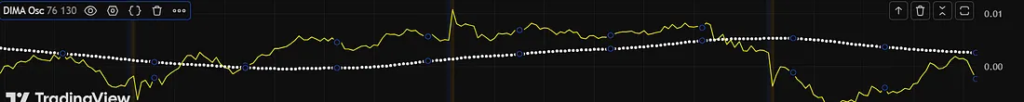

Indicator 2: Dimbeta Moving Average Oscillator (Trend Confirmation)

The DIMMA oscillator uses two dynamic moving averages and acts as your trend filter.

How to Add

- Search: Dimbeta Moving Average Oscillator

- Add the first result

Your setup is now complete. Let’s enter trades.

How to Trade the Strategy

There are just three conditions for both Buy and Sell entries.

If even one doesn’t match — skip the trade.

🔻 SELL SETUP (Short Entry)

Enter a sell only when all three are true:

- Log Pressure prints a SELL arrow

- DIMMA crosses below (trend turning bearish)

- Candle closes as a bearish candle

Stop-Loss

- Previous swing high

Target

- Risk:Reward = 1 : 1.5

This simple structure prevents emotional trades and avoids fake breakouts.

🔼 BUY SETUP (Long Entry)

Enter a buy only when all three match:

- Log Pressure prints a BUY arrow

- Dimbeta line crosses above moving average

- Candle closes bullish

Stop-Loss

- Previous swing low

Target

- Risk:Reward = 1 : 1.5

The entries are incredibly clean, and most setups reach the target quickly in trending conditions.

Why This Strategy Performs Surprisingly Well

✔ 1. Built-in Discipline

You cannot enter unless all three layers align—arrow, trend, candle.

✔ 2. Naturally Avoids Overtrading

No signal = no trade.

Perfect for beginners who struggle with impulse entries.

✔ 3. Signal + Trend = High Accuracy

One indicator tells you where, the other tells you when.

This combination removes confusion.

✔ 4. Works Best on Nifty / BankNifty / 5-Minute Charts

Fast movement + clean structure = strong RR.

✔ 5. Extremely Visual

Arrows, color shifts, and candle direction make execution easy to follow.

Pro Tips to Boost Accuracy (Tested)

Avoid trading during:

- Major news events

- Sideways or choppy markets

- First 5 minutes after market open

Trade only when:

- DIMMA line shows strength (not flat)

- Candle closes fully (no early entries)

- SL and targets are visually clear

These simple filters significantly improve win-rate.

Final Thoughts — Should You Use This Strategy?

Absolutely—if you want a clean, simple, 2-indicator system that removes confusion and improves discipline.

The rules are crystal clear, entries are visual, and beginners can learn it in minutes.

If you’re looking for an easy framework to start scalping effectively, this is a strategy worth practising right away.