If you’ve ever felt frustrated by sideways markets or confused by too many indicators, you’re not alone. Most traders overcomplicate things — adding more tools, more confluence, and still ending up in losing trades.

This post is going to simplify all of that.

👉 In this strategy, we use just two powerful indicators to catch high-probability breakout trades:

🔹 CT Breakout Labels [Uncle Sam Trading]

🔹 Two-Pole Oscillator [BigBeluga]

Together, these tools filter fakeouts, confirm trends, and give clean buy and sell signals with precision.

Let’s dive into this momentum breakout strategy that even beginners can use confidently.

🔍 The Core Idea

This strategy is built around two strong trading principles:

- Breakout Confirmation: Using CT Breakup/Breakdown signals to identify when the price breaks out of a range.

- Momentum Validation: Using the Two-Pole Oscillator to confirm the direction of strength and avoid false signals.

You don’t need to be a pro — just follow the signals and manage your trades with discipline.

🔧 Indicator Setup

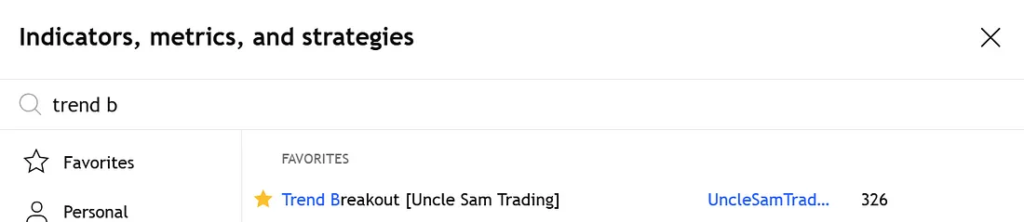

1. CT Breakout by Uncle Sam Trading

This indicator identifies consolidation zones and marks moments where the price is ready to break out.

Settings:

- Lookback:

5 - Sensitivity:

1 - Filter Strength:

50

Key Signals:

- 🟩 CT Breakup = Potential Bullish Breakout

- 🟥 CT Breakdown = Potential Bearish Breakout

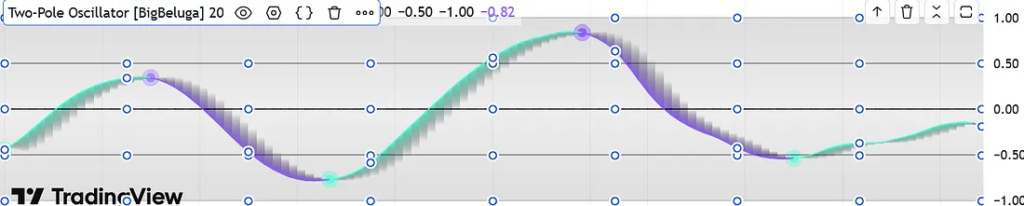

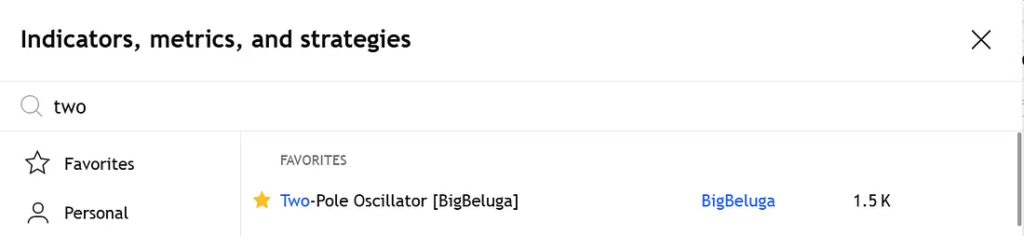

2. Two-Pole Oscillator by BigBeluga

This is a momentum cycle indicator that helps spot early reversals or exhaustion points.

Settings:

- Length:

20

How to Read It:

- 🔼 Curving up from below zero → Bullish reversal

- 🔽 Curving down from above zero → Bearish reversal

- Above

+0.7= Overbought (exit long) - Below

-0.7= Oversold (exit short)

If you wish to know more Trading hacks you can read here

📈 How to Add the Indicators on TradingView

- Open TradingView

- Click on

Indicators - Search:

✅CT Breakout (Uncle Sam Trading)

✅Two-Pole Oscillator (BigBeluga) - Apply them to a

5-minute chart - Use default settings or adjust based on asset volatility

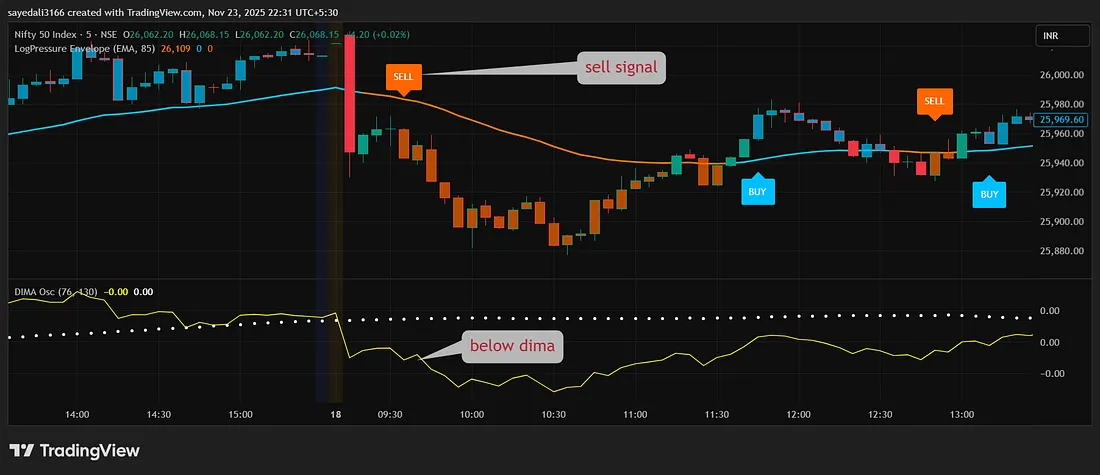

🟢 Buy Entry Rules (Long Setup)

Conditions:

- ✅ CT Breakup appears below a green candle

- ✅ Two-Pole Oscillator is below 0 and curving upward

- ✅ A green dot appears (bottomed-out cycle)

- ✅ Background is narrow red (early shift in pressure)

Confirmation:

- Price breaks above previous candle’s high

- Volume spike (optional but helpful)

Entry: Next candle after confirmation

Stop-Loss: Recent swing low

Target: Oscillator reaches above +0.7 or curves downward

🔴 Sell Entry Rules (Short Setup)

Conditions:

- ✅ CT Breakdown appears above a red candle

- ✅ Two-Pole Oscillator is above 0 and curving downward

- ✅ A purple dot appears (cycle top)

Confirmation:

- Price breaks below the previous candle low

- Continued bearish momentum

Entry: Next candle after CT Breakdown

Stop-Loss: Recent swing high

Target: Oscillator drops below -0.7 or flattens out

💡 Key Tips to Remember

- ❌ Don’t trade on CT labels alone — confirm with the oscillator!

- ⚠️ Avoid flat oscillator zones (near zero) → usually sideways chop

- ✅ Works best on high-volume assets like Nifty50, S&P 500, BTC/USD

- ⏰ Ideal trading time: 9:30–11:30 AM or 1:30–3:00 PM (high volatility windows)

🔄 How to Backtest This Strategy

- Load indicators on a 5-minute chart

- Scroll back and mark:

- CT Breakup/Breakdown labels

- Oscillator movement (dot + curve direction)

- Track:

- ✅ Win/Loss Ratio

- ✅ Average R:R

- ✅ Time held in trade

- Log results in Excel/Google Sheets

- Optimize stop-loss & target based on historical performance

📌 Pro Tip: Set TradingView alerts on “CT Breakup” or “CT Breakdown” for semi-automated scalping.

🎯 Who Is This Strategy For?

✅ Beginners looking for clear entries

✅ Scalpers who trade S&P 500 / BTC / Nifty

✅ Traders who hate laggy indicators and love price action with momentum

📚 FAQ – Quick Answers

Q1: Can I use this for crypto trading?

Absolutely. Works well on BTC, ETH, and SOL — especially during high-volume hours.

Q2: Best time frame?

5-min for intraday. You can also scale it to 15-min or 1H for swing setups.

Q3: Is the Two-Pole Oscillator better than RSI?

Yes. It’s smoother, reacts quicker, and helps with short-term cycle detection.

Q4: Is this beginner-friendly?

Definitely. Easy-to-read signals, especially once you backtest a few trades.

✅ Final Thoughts

The CT Breakout + Two-Pole Oscillator combo is your tactical edge in a noisy market. With just two tools, you can spot momentum shifts, ride strong trends, and avoid sideways traps.

Whether you’re catching a breakout on BTC or shorting Nifty reversals, this system is simple, effective, and beginner-approved.

🎯 Start using this strategy today and make your intraday trades count.

📘 Want More Like This? Explore My eBooks 👇

If you found this strategy helpful, imagine having 25 more like this — all tested, beginner-friendly, and powerful.

🔥 New Releases on Gumroad:

- ✅ 25 Intraday Trading Strategies in 2025

- ✅ Options and Futures for Beginners 2025

- ✅ 15 Intraday Trading Indicators

- ✅ Stock Market for Beginners — Your complete guide to stock investing from scratch