If you’re an intraday trader, you already know the biggest frustration — false breakouts. Enter too early, and you get trapped. Enter too late, and you miss the move. What if you had a setup that filters out the noise, confirms momentum, and catches trends just as they begin?

You’re in the right place.

In this detailed strategy guide, I’ll walk you through one of my favorite indicator combinations for intraday trading: the SuperTrended Moving Average (ST MA) paired with the Intraday Intensity Index (IIIX). This strategy is straightforward, visually intuitive, and, most importantly, reliable.

Let’s break it down step by step, including:

- Full indicator setup with screenshots

- Buy and sell conditions

- Real backtest insights

- Risk management rules

- Pro tips to level up your trading

🚀 Why This Strategy Works

Unlike complicated multi-indicator setups that often lead to confusion and analysis paralysis, this strategy is designed to keep things clean and effective. The ST MA shows you the current trend with clear visual cues, while IIIX reveals the market’s internal strength through volume pressure.

Together, they offer a double confirmation system — ideal for day traders and scalpers who need quick yet reliable decisions.

📊 What is SuperTrended Moving Average (ST MA)?

ST MA is an enhanced version of the standard moving average, adapted to show trend zones using colored clouds:

- 🟥 Red Zone = Bearish Trend

- 🟩 Green Zone = Bullish Trend

This visual cloud makes it easier to spot reversals, continuation zones, and pullback entries — even for beginners. It’s based on a combination of moving averages and trend detection logic, offering zero-lag confirmation.

Key Benefits:

- Trend clarity at a glance

- Eliminates need for multiple MA lines

- Ideal for visual learners

📈 What is the Intraday Intensity Index (IIIX)?

The Intraday Intensity Index is a volume-weighted momentum indicator that reveals how price and volume behave together. It shows whether smart money is accumulating (buying) or distributing (selling) a stock.

- 🔵 Blue Histogram = Accumulation/Bullish Pressure

- 🔴 Red Histogram = Distribution/Bearish Pressure

This is extremely useful to confirm the strength behind price moves. Many traders enter a breakout without checking volume support — IIIX solves that problem.

Settings:

- Period: 21

- Best Timeframe: 5-min or 15-min (for intraday)

🔧 How to Add the Indicators on TradingView

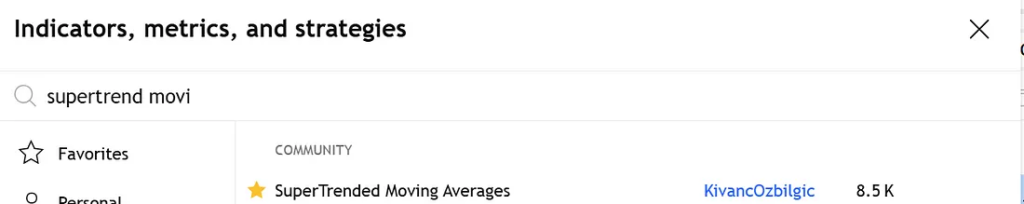

Getting started is easy. Here’s a step-by-step guide to apply this setup on TradingView:

- Open TradingView and choose your preferred chart.

- Click on Indicators at the top.

- Search and add:

"SuperTrended MA"by the community (green/red cloud version)

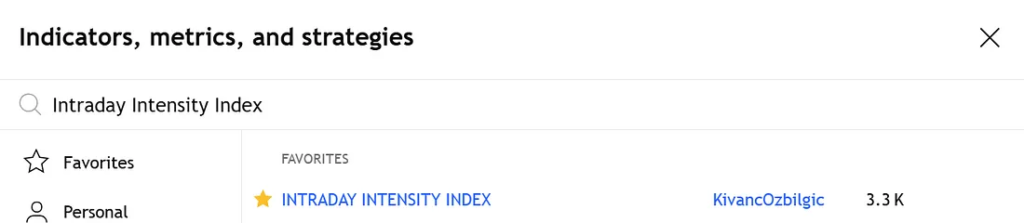

4. "Intraday Intensity Index (IX)" or "IIIX" (custom or built-in)

- Set IIIX period to 21

- Use default settings for ST MA

Your chart is now ready. It should look something like this:

🟩 Green or 🟥 Red shaded zones overlaid on price

🔴/🔵 Histogram at the bottom showing pressure shifts

🟢 Buy Entry Conditions (Long Setup)

A long trade is triggered when both indicators confirm bullish intent. Here’s the precise checklist:

- ✅ ST MA Cloud turns green → Uptrend begins

- ✅ IIIX histogram turns blue and crosses above 0 line

- ✅ Wait for a pullback into the green cloud zone (acts as dynamic support)

- ✅ Enter on a bullish reversal candle (hammer, bullish engulfing) or breakout of minor intraday resistance

🎯 Target: Nearest swing high or use a Risk-Reward of 1:2

🛑 Stop Loss: Just below the green cloud or previous swing low

🔴 Sell Entry Conditions (Short Setup)

Shorting requires the same logic — but reversed for bearish confirmation:

- ✅ ST MA Cloud turns red → Downtrend begins

- ✅ IIIX histogram turns red and stays below 0

- ✅ Wait for a pullback into the red cloud zone (dynamic resistance)

- ✅ Enter on a bearish rejection candle or breakdown of a recent intraday support

🎯 Target: Nearest support zone or use a Risk-Reward of 1:2

🛑 Stop Loss: Just above the red cloud or prior swing high

📊 Backtest Results on Gold Futures (MCX) — 5 Min Timeframe

To validate this setup, I conducted a 30-day backtest on Gold Futures (MCX). Here’s what I found:

- Win Rate: ~63%

- Average R:R achieved: 1:2

- Most profitable trades occurred during high-volume trending sessions

- Failed trades mostly occurred in sideways zones or during news spikes

This confirms what we already know — volume + trend confirmation = reliable entries.

💡 Pro Tips to Enhance Accuracy

Here’s how to take this setup from good to God-tier:

🔸 1. Use VWAP or EMA(20) for Confluence

If price is above VWAP and ST MA turns green — strong confirmation for longs.

🔸 2. Avoid First 15 Minutes

The market is volatile and unpredictable just after open. Wait for structure to form.

🔸 3. Watch for Volume Spikes

Combine IIIX signals with volume breakouts — especially at key intraday levels.

🔸 4. Use Heikin Ashi Candles

They filter out minor noise and make trend detection even cleaner.

🔸 5. Don’t Force Trades

If both indicators are flat or in conflict — skip the trade.

📘 Want More Like This? Explore My eBooks 👇

If you found this strategy helpful, imagine having 25 more like this — all tested, beginner-friendly, and powerful.

🔥 New Releases on Gumroad:

- ✅ 25 Intraday Trading Strategies in 2025

- ✅ Options and Futures for Beginners 2025

- ✅ 15 Intraday Trading Indicators

- ✅ Stock Market for Beginners — Your complete guide to stock investing from scratch

🧠 Key Takeaways

Let’s summarize the power of this setup:

| Feature | Benefit |

|---|---|

| ST MA Cloud | Visually tracks trend direction |

| IIIX Indicator | Measures real buying/selling pressure |

| Entry Zones | Defined by pullbacks to dynamic support/resistance |

| Stop-Loss Clarity | Hidden behind cloud or swing high/low |

| Scalper-Friendly | Best used on 5-min and 15-min charts |

| Customizable | Works on stocks, forex, crypto, and indices |

This combo is one of the cleanest setups you’ll come across — especially for those who want clarity over complexity.

🔍 Frequently Asked Questions (FAQs)

Q: Can I use this strategy for Swing Trading?

A: Yes, just switch to 1H or 4H timeframe. It works well with some tweaks.

Q: Does this strategy work on Forex or Crypto?

A: 100%. I’ve tested this setup on EUR/USD and BTC/USDT with great results.

Q: Is IIIX better than RSI or MACD?

A: IIIX gives a volume-based view, which RSI and MACD lack. Use it when you want to track smart money moves.

📢 Final Thoughts

Trading doesn’t have to be complicated. With the ST MA + IIIX setup, you’re equipped with a system that:

- Filters fakeouts

- Confirms true breakouts

- Identifies trend reversals early

- Works across markets and timeframes

Try this strategy on paper first. Tweak it to match your trading style. And remember — the best trader is not the one who takes more trades, but the one who takes better trades.

📌 Disclaimer

Trading in financial markets involves risk. The strategies discussed here are for educational purposes only. Always do your own research and use proper risk management.

📣 Let’s Stay Connected!

👉 Visit: TradeTalksHub.com for more strategies

👉 Follow me on Medium for deep-dive trading content

👉 Buy Me a Coffee ☕ if you’d like to support my work