Are you fed up with using lagging indicators that fail to catch the real momentum of the market? You’re not alone.

Every intraday trader has faced this: entering too late, exiting too early, or misjudging a trend. But what if there was a smarter way to anticipate high-probability reversals and breakdowns—before they happen?

In this guide, I’ll show you a powerful trading setup that combines:

✅ NeuroTrend (10,21) – a smart trend-detection and momentum tool

✅ VAPI (Volume Accumulation Percentage Indicator) – a volume-based oscillator by LazyBear

✅ Real-world strategy demonstration on Crude Oil Futures (MCX, 5-min)

✅ Step-by-step instructions to set it up for FREE on TradingView

🔍 Understanding the Indicators

✅ NeuroTrend: Smart Trend Detection

The NeuroTrend indicator is designed to identify impulse moves and potential reversals with a visual cue. Built on neural net logic and exponential smoothing, it labels:

- Confirmed Bullish/Bearish trends

- Reversal signals

- Momentum shifts

The visual ribbon makes it easy to interpret trend phases with labels like “Impulse,” “Reversing Now,” or “Bearish Breakdown.” This clarity is ideal for fast-paced intraday decision-making.

✅ VAPI (Volume Accumulation Percentage Indicator)

Developed by LazyBear, VAPI measures buying and selling pressure through volume analysis. It is similar to the On-Balance Volume (OBV) but with a more dynamic representation:

- Green bars = Accumulation (buying strength)

- Red bars = Distribution (selling strength)

- Above 0 = Positive accumulation

- Below 0 = Dominant selling

The further the value from zero, the stronger the conviction of that directional volume.

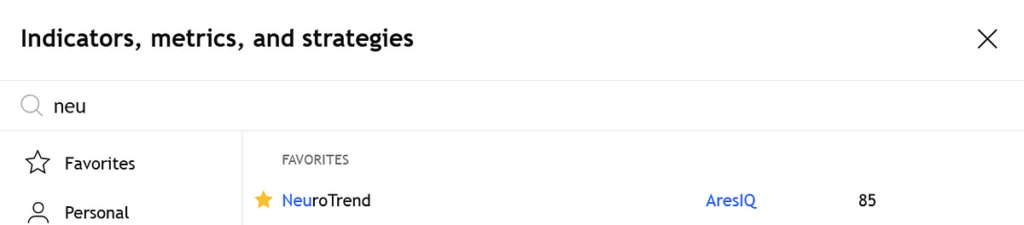

🔧 How to Add NeuroTrend & VAPI on TradingView

Follow these steps to add both indicators for free:

- Log in to TradingView

- Click on Indicators > Search and add “NeuroTrend” (from Public Library)

- Search “VAPI_LB” and add LazyBear’s version

- Set VAPI length to 10

- Color-code NeuroTrend bands: Green for uptrend, Red for downtrend

📘 Upgrade Your Trading Toolbox

Take your learning to the next level with my latest eBooks:

🔥 New Releases on Gumroad:

- ✅ 25 Intraday Trading Strategies in 2025

- ✅ Options and Futures for Beginners 2025

- ✅10 Buy and Sell Custom Indicators

- ✅ 15 Intraday Trading Indicators

- ✅ Stock Market for Beginners — Your complete guide to stock investing from scratch

🧠 Strategy Logic: Combine NeuroTrend + VAPI for High-Conviction Trades

This setup is especially effective for intraday breakdowns or reversal confirmation, particularly in high-volume assets like Crude Oil Futures.

📈 Buy Conditions (Reversal or Continuation)

- NeuroTrend shows: “Impulse Bullish” or “Reversing Now (Up)”

- Price closes above the NeuroTrend ribbon

- VAPI turns green and rises, preferably above +5

- Entry: Breakout above the next candle’s high

- Stop Loss: Below NeuroTrend band

- Target: 1.5x to 2x SL or trail using NeuroTrend’s slope

📉 Sell Conditions (Breakdown or Reversal)

- NeuroTrend shows: “Impulse Bearish” or “Reversing Now (Down)”

- Price closes below the NeuroTrend ribbon

- VAPI turns red, falling below -5

- Entry: Break of the breakdown candle’s low

- Stop Loss: Above the NeuroTrend band or previous swing high

- Target: 1.5x SL or support levels

Risk-Reward Tips:

- Avoid neutral setups (when NeuroTrend is flat and VAPI is sideways)

- Look for volume spikes as entry confirmation (VWAP is a great filter)

- Never skip the stop loss—Crude Oil is volatile; 5–8 point SL is typical for 5-min setups

💡 Pro Tips to Optimize the Setup

- 📌 Add VWAP for further entry validation

- 📌 Use Pivot Point Indicator to gauge reversal zones

- 📌 Trade after 2:00 PM IST for Crude Oil to avoid early-session volatility

- 📌 Confirm signals with candle patterns like bullish/bearish engulfing or pin bars

🧾 Final Thoughts: Is This the Ultimate Setup?

This strategy isn’t magic. It’s not a “holy grail.”

But it works—when you stick to the rules, practice patience, and follow a structured plan.

By combining NeuroTrend’s smart trend detection with VAPI’s volume analysis, you remove guesswork and trade with data-backed conviction.

It’s not about prediction.

It’s about reading price and volume in real-time—with clarity.