As traders, we’re always hunting for that sweet spot — the precise moment when the bulls give up, and the bears take over… or vice versa. It’s the kind of shift that makes or breaks a trade.

But here’s the truth: most reversals aren’t gentle. They’re aggressive. They flip fast. If you’re not prepared, you either miss the move or get caught in the wrong direction.

That’s where this setup shines — it’s called the Bull-Bear Flip, and it’s powered by:

- Bull Bear 180 Candlestick Pattern (Oliver Velez)

- Intraday Intensity Indicator (a powerful volume-pressure tool)

When these two indicators align, you’re no longer guessing. You’re reacting to a high-probability shift backed by both price and volume.

Let’s dive in.

🧠 What Is the Bull Bear 180?

The Bull Bear 180 is one of Oliver Velez’s signature reversal patterns. It’s visually powerful, easy to spot, and deadly accurate when confirmed with volume.

Here’s how it works:

Bullish 180:

- A strong red bearish candle forms (panic selling).

- It’s immediately followed by a strong green bullish candle that not only engulfs the red one but closes above its high.

This shows a complete shift in sentiment — the bulls didn’t just show up, they took over the battlefield.

Bearish 180:

- A strong green bullish candle appears.

- Followed by a strong red candle that engulfs and closes below the first.

It’s a flip — from domination to surrender — in just two candles. That’s what makes it so explosive.

🔍 The Intraday Intensity Indicator (IIX)

Now here’s the twist — not every 180 pattern is worth trading.

That’s why I filter them using the Intraday Intensity Indicator. Think of it as a volume-pressure sensor. It tells you whether the real money is supporting the move or not.

- Blue bars above 0 = Buying pressure

- Red bars below 0 = Selling pressure

When the Bull Bear 180 aligns with a matching volume shift, the setup becomes high-conviction.

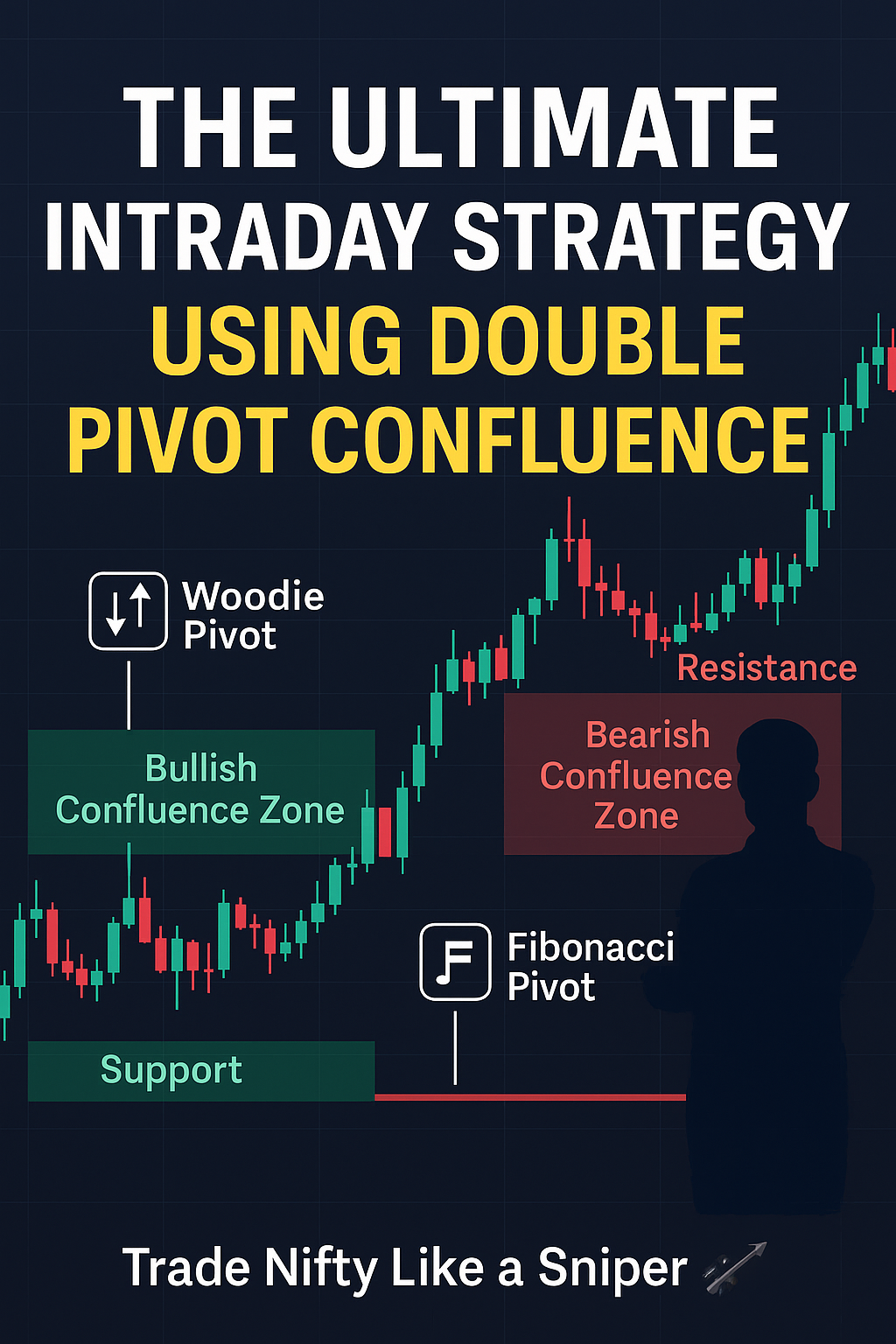

Below are my new ebooks.

If you’ve ever felt lost in the chaos of market moves, it’s time to bring structure to your strategy. My new ebook, CPR MASTER CLASS, breaks down one of the most powerful tools in price action trading — Central Pivot Range — and shows you exactly how to trade with confidence, clarity, and consistency.

✅ Learn CPR, Virgin CPR, Camarilla, Volume, VWAP, and more

✅ Includes real chart examples, setups, and TradingView guides

✅ Instant download, lifetime access👉 Grab your copy now on Gumroad:

🚀 Ready to Supercharge Your Trading? 📈

If you’re tired of guesswork and want to trade confidently using advanced indicators that actually work, my ebook “Advanced Technical Indicators for Your Trading Journey” is exactly what you need!

👉 Click here to grab your copy on Gumroad now! 👈

BUY NOW 25 Intraday Trading Strategies in 2025. 🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!” ‘ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

BUY NOW OPTIONS AND FUTURES FOR BEGINNERS 2025

‘📗 ’15 Intraday Indicators’ — Master the most powerful technical indicators for precision trading. Learn how to spot high-probability setups, confirm trends, and optimize your entries and exits like a pro.

‘Stock Market for Beginners’ — Your ultimate guide to understanding the stock market from scratch! Learn essential terms, beginner-friendly strategies, and how to grow your wealth — no prior experience is needed

🛠 How to Set It Up in TradingView

Step 1: Add Bull Bear 180 (Oliver Velez)

- Go to Indicators

- Search: “Bull Bear 180 by Oliver Velez”

- Add the one that marks bullish/bearish 180 patterns with a clear label (often 🐂 or 🐻)

Step 2: Add Intraday Intensity Indicator

- Click Indicators

- Search: “Intraday Intensity” or “Intraday Intensity Index”

- Add the histogram-style one with blue and red pressure bars

🟢 Buy Entry Conditions (Bullish Flip)

- A Bullish 180 pattern forms (green candle engulfs red)

- Intraday Intensity shows strong blue bars above 0

- Ideally, price is bouncing off a support zone or VWAP

- Entry on the close of the 180 pattern

📍 Stop Loss: Below the low of the 180 pattern

🎯 Target: 1:2 RR, or next resistance/pivot

🔴 Sell Entry Conditions (Bearish Flip)

- A Bearish 180 pattern appears (red candle engulfs green)

- IIX shows red bars below 0

- Ideally, near resistance or after a failed breakout

- Enter at the close of the pattern

📍 Stop Loss: Above the 180 pattern high

🎯 Target: 1:2 or to the next support zone

This setup works beautifully in volatile assets — crypto, metals.

📌 Why This Strategy Works

1. Price + Volume Reversal

The 180 pattern shows a price flip. The IIX shows volume flip. Together, you’ve got conviction.

2. Visually Clean & Fast

You don’t need complex indicators. Two candles, one histogram, and you’re in business.

3. Perfect for Intraday

This strategy works best on 15M to 1H timeframes — perfect for active day traders.

💡 Tips from My Trade Journal

- ✅ Trade only clean 180s — avoid weak candles or small-bodied signals

- ✅ Use this during high-volume sessions (first 90 mins or post-lunch)

- ⚠️ Avoid trading during overlapping news events (FOMC, CPI, etc.)

- 🧪 Always backtest this pattern before live trades — it thrives in certain assets more than others

🧠 Advanced Tweaks

- Add VWAP or CPR to add structure to your setup

- Use EMA(20) to trade only in the dominant direction

- Mark previous day high/low — 180 flips near those zones are deadly

❓FAQ: Bull Bear 180 + IIX

Q: Can I automate alerts on TradingView?

Yes! Set alerts for Bull Bear 180 + use a visual cross-check for volume.

Q: What’s the average success rate?

In trending or high-volume markets, I’ve seen up to 70% accuracy using a 1:2 RR plan.

Q: What if IIX doesn’t confirm the 180?

Skip the trade. Price without volume is a trap.

🧾 My Personal Closing Notes

Every trader wants to catch the exact moment the tide turns.

The Bull-Bear 180 is that moment. But the ocean has layers, and volume is its undercurrent.

When price structure and volume align, you don’t just have a trade — you have a story. A story of power shifting hands.

Learn to read that story.

Wait for the flip.

And when the bears panic and bulls pounce — that’s your time.