If you’ve ever opened a trading chart and felt your brain instantly switch into confusion mode, you’re not alone.

Many beginner traders — and even some experienced ones — feel overwhelmed by the endless lines, indicators, and technical jargon. The good news? Trading doesn’t need to be that complicated.

In this guide, we’re diving into one of the most powerful yet beginner-friendly TradingView tools — the Ranges and Breakouts Indicator — and showing you how to combine it with the Trend Reversal Probability Indicator to spot high-probability trades.

Whether you trade stocks, forex, cryptocurrencies, or commodities, this step-by-step strategy can help you catch big moves while keeping your risk small.

Why Market Breakouts Can Make or Break Your Trading Success

Trending keywords: market breakout strategy, breakout trading, trading signals, forex breakouts, crypto breakout strategy

Before we start with the tools, let’s break down a key concept — breakouts.

A breakout happens when the price moves beyond a level it has been stuck at for a while.

Imagine a ball bouncing between two walls (support and resistance). One day, the ball smashes through one wall — that’s a breakout. In trading, this “break” often leads to a strong price move and an opportunity for profit.

The catch? Not all breakouts are real. Sometimes, price pops out only to fall right back inside — a fake breakout. That’s why we need indicators that confirm whether a breakout has strength.

Step-by-Step Setup on TradingView

Trending keywords: TradingView indicator setup, best trading indicators, how to use TradingView

TradingView is the go-to charting platform for millions of traders worldwide. Here’s how to set up this strategy in three simple steps:

Step 1: Clean Your Chart

A cluttered chart is a confused chart.

Remove unnecessary indicators and start with a blank canvas so you can clearly see price movements.

Step 2: Add the Trend Reversal Probability Indicator

This is your confirmation tool.

- Click the Indicators button in TradingView.

- Search “Trend Reversal Probability”.

- Add it to your chart.

This indicator uses color-coded bars:

- 🟢 Green = Uptrend probability

- 🔴 Red = Downtrend probability

Step 3: Add the Ranges and Breakouts Indicator

Now for the main tool.

- Go to Indicators again.

- Search “Ranges and Breakouts by Algo Alpha”.

- Add it to your chart.

You’ll now see buy and sell signals appear when the market is likely to make a strong move.

How to Use the Ranges and Breakouts Strategy

Trending keywords: breakout trading strategy, buy and sell signals, profitable trading strategy

This method works in both bullish and bearish markets. Let’s break it into buying and selling conditions.

🟢 Buying Setup

- Wait for a buy signal from the Ranges and Breakouts Indicator.

- Confirm the Trend Reversal bars are green (uptrend probability).

- Place your buy order.

- Set a stop-loss just below the most recent low.

- Aim for a reward twice your risk (risk $10 to make $20).

🔴 Selling Setup

- Wait for a sell signal from the Ranges and Breakouts Indicator.

- Confirm the Trend Reversal bars are red (downtrend probability).

- Place your sell order.

- Set a stop-loss just above the most recent high.

- Aim for a 2:1 reward-to-risk ratio.

Risk Management – The Hidden Power Behind This Strategy

Trending keywords: risk management in trading, stop loss strategy, money management in forex

One of the biggest advantages here is that you don’t need to win every trade.

The 2:1 risk-reward ratio ensures profitability even with a 40% win rate.

Example:

- Risk per trade: $50

- Target profit: $100

- Out of 5 trades → win 3, lose 2

- Wins = $300, Losses = $100 → Net Profit = $200

Backtesting – Practice Before You Risk Real Money

Trending keywords: backtesting trading strategy, paper trading, TradingView backtest

Before risking real capital:

- Use TradingView’s replay mode to test the strategy on past charts.

- Try different markets: crypto, stocks, forex, indices.

- Experiment with timeframes: 15m, 1h, 4h.

This builds confidence and helps you understand how the indicator behaves in different market conditions.

Pro Tips for Boosting Your Success

- Trade liquid markets – avoid low-volume assets.

- Avoid news spikes – high volatility can cause fake breakouts.

- Stick to your stop-loss – never move it hoping price will “come back.”

- Journal every trade – learn from both wins and losses.

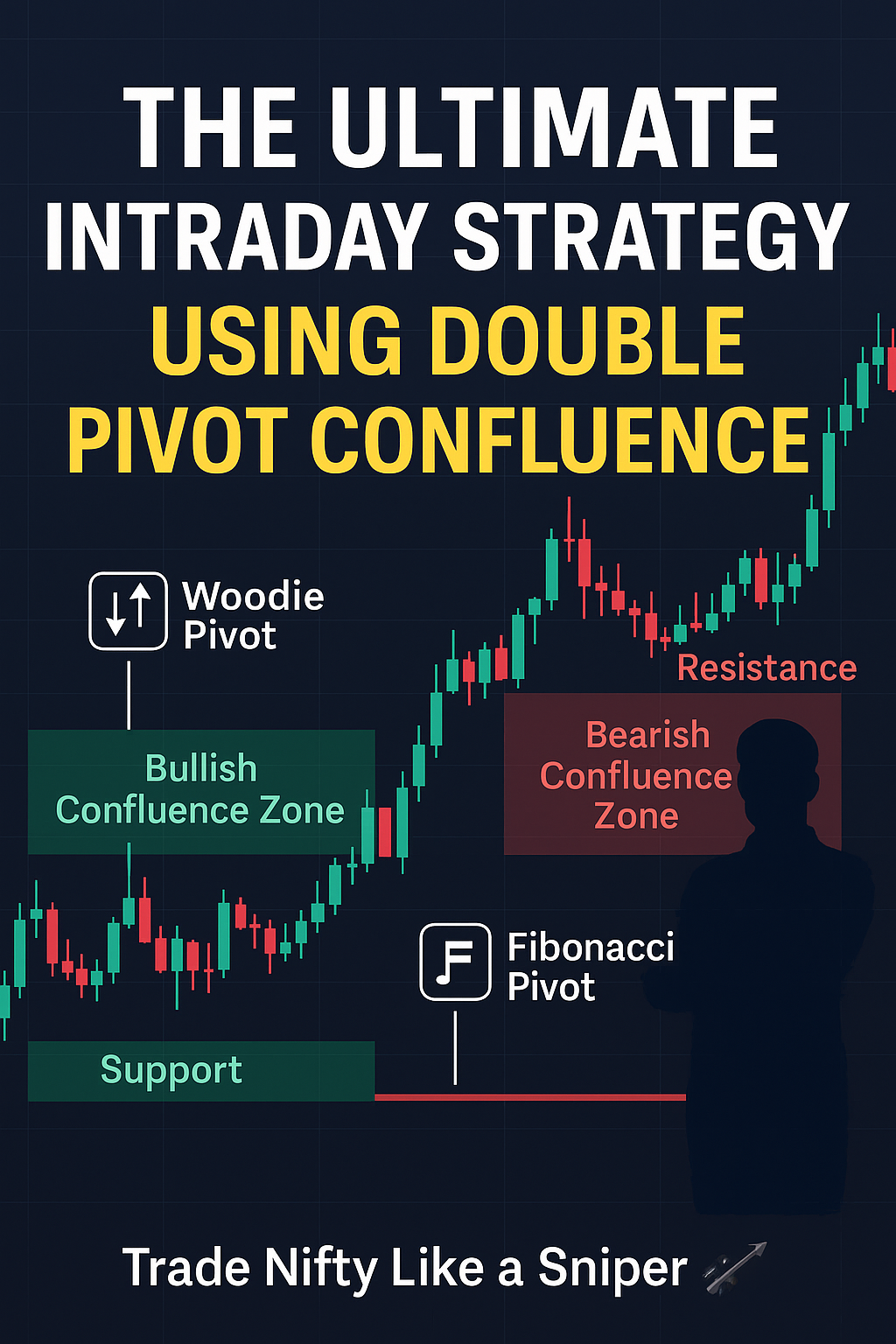

Combining This Strategy with Other Tools

For even higher accuracy, you can combine:

- CPR (Central Pivot Range) for intraday support/resistance

- VWAP for institutional price levels

- Volume analysis for breakout strength

Common Mistakes to Avoid

- Overtrading every signal

- Ignoring confirmation from Trend Reversal bars

- Trading during major economic announcements

- Risking too much per trade

Why This Strategy Works in 2025

Markets are getting faster and more algorithm-driven. The Ranges and Breakouts Indicator works well because:

- It identifies consolidation zones before big moves.

- It combines price action with algorithmic analysis.

- It works across multiple assets and timeframes.

Is This Strategy for You?

This method is ideal if you:

- Prefer clear, rule-based trading

- Use TradingView regularly

- Want a balance between simplicity and accuracy

- Are willing to practice before going live

Conclusion – Keep It Simple, Trade Smart

Trading doesn’t have to be complicated.

By combining the Ranges and Breakouts Indicator with the Trend Reversal Probability Indicator, you get clear entry and exit points and a proven way to manage risk.

Key reminders:

- Follow the rules strictly.

- Always use stop-loss.

- Aim for at least a 2:1 reward-to-risk ratio.

- Keep learning and adapting.

If you’re ready to level up your trading in 2025, start practicing this strategy on a demo account today — and when you go live, trade with discipline and confidence.