Suppose you’re searching for an intraday trading strategy that works across stocks, forex, and crypto. In that case, this method combines the Gad Quantum Research indicator with the Adaptive Resonance Oscillator to spot high-probability buy and sell trades.

This strategy is designed for the 5-minute timeframe, making it ideal for scalpers and day traders looking for quick trade setups. Let’s break it down step by step.

Ready to transform your financial future and dominate the stock market? Whether you’re a beginner looking to take your first steps or a trader hungry for proven strategies, I’ve got you covered! 📘

‘📗 ’15 Intraday Indicators’ — Master the most powerful technical indicators for precision trading. Learn how to spot high-probability setups, confirm trends, and optimize your entries and exits like a pro.

‘📗 ’25 Intraday Strategies in 2025🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!” ‘ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

Stock Market for Beginners is your ultimate guide to understanding the market from scratch. Learn essential terms, beginner-friendly strategies, and how to start growing your wealth — no experience needed!

How to Set Up the Indicators on TradingView

- Open TradingView and launch a new chart.

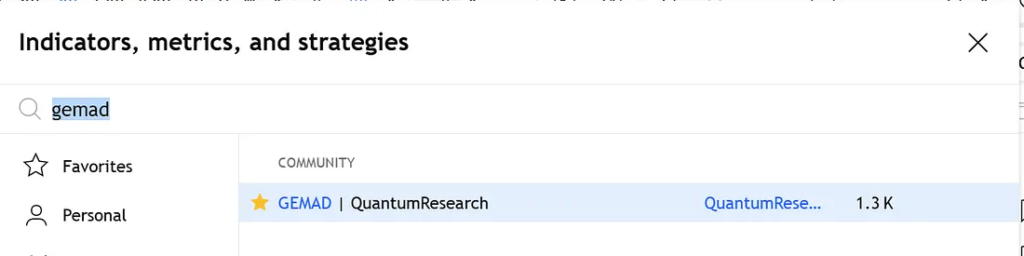

2. In the Indicators section, search for “Gad Quantum Research” and select the Gemmad Quantum Research option.

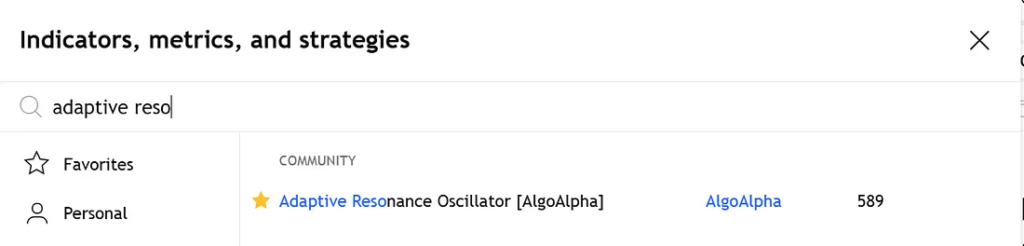

3. Next, search for “Adaptive Resonance Oscillator” and apply it to the chart.

Once applied, your chart setup is ready for trading.

Buy Conditions (Long Entry)

✅ Gad Quantum Research indicator line should be blue.

✅ The market must form a bullish candle.

✅ The Adaptive Resonance Oscillator must show bullish momentum above 50

✅ Once all conditions are met, place a buy order.

✅ Stop Loss: Below the recent low (based on the Gad Quantum Research indicator).

✅ Take Profit: 1:1.5 risk-to-reward ratio.

📌 Example: If the stop loss is set at 10 pips, the take profit should be at 15 pips.

Sell Conditions (Short Entry)

✅ Gad Quantum Research indicator line should be blue.

✅ The market must form a bearish candle.

✅ The Adaptive Resonance Oscillator must show bearish momentum below 50

✅ Once all conditions are met, place a sell order.

✅ Stop Loss: Above the recent high (based on the Gad Quantum Research indicator).

✅ Take Profit: 1:1.5 risk-to-reward ratio.

📌 Example: If the stop loss is 10 pips, the take profit should be 15 pips.

Key Takeaways

This strategy is designed for the 5-minute timeframe, making it ideal for intraday traders.

The Gad Quantum Research indicator helps identify the trend direction.

The Adaptive Resonance Oscillator confirms trend strength and momentum.

Strict risk management with a 1:1.5 risk-to-reward ratio ensures steady profits.

Always backtest the strategy before trading with real capital.

Final Thoughts

A solid trading strategy is built on consistency, discipline, and risk management. This method, combining the Gad Quantum Research indicator with the Adaptive Resonance Oscillator, provides a structured approach to identifying high-probability trades in intraday markets.

However, no strategy is foolproof. Backtesting and practice are essential to understand its effectiveness before trading with real capital. Stick to the rules, manage your risk wisely, and focus on long-term success.

By following this strategy with patience and discipline, you can make more informed and confident trading decisions. Stay committed to learning, refining your approach, and growing as a trader. Success in trading comes to those who stay consistent.