In the dynamic world of cryptocurrency trading, having a reliable and straightforward strategy is essential for success. This guide introduces a powerful method that combines two advanced technical indicators: the SAR + Deviation [BigBeluga] and the SNT3 (Kaufman Adaptive Moving Average). By integrating these tools into your trading approach, you can enhance decision-making and optimize your trading performance across various assets, including Ethereum (ETH/USD), other cryptocurrencies, commodities, and stocks.

Understanding the SAR + Deviation [BigBeluga] Indicator

The SAR + Deviation [BigBeluga] is an enhanced version of the traditional Parabolic SAR indicator, designed to detect trends while incorporating deviation levels and trend change markers for added depth in analyzing price movements.

Key Features:

- Optimized Parabolic SAR: Utilizes predefined default settings to improve trend detection and confirmation.

- Deviation Levels: Incorporates deviation levels to provide insights into price volatility and potential breakout points.

- Trend Change Markers: Highlights potential trend reversals with visual markers, aiding in timely decision-making.

Below are my new ebooks.

🚀 Ready to Supercharge Your Trading? 📈

If you’re tired of guesswork and want to trade confidently using advanced indicators that actually work, my ebook “Advanced Technical Indicators for Your Trading Journey” is exactly what you need!

👉 Click here to grab your copy on Gumroad now! 👈

BUY NOW 25 Intraday Trading Strategies in 2025

BUY NOW OPTIONS AND FUTURES FOR BEGINNERS 2025

15 INTRADAY TRADING INDICATORS

‘Stock Market for Beginners’ — Your ultimate guide to understanding the stock market from scratch! Learn essential terms, beginner-friendly strategies, and how to grow your wealth — no prior experience is needed

Exploring the SNT3 (Kaufman Adaptive Moving Average) Indicator

The SNT3, based on the Kaufman Adaptive Moving Average (KAMA), is a trend-following indicator that adjusts its sensitivity based on market volatility. Developed by Perry Kaufman, the KAMA aims to filter out market noise and provide a clearer picture of the underlying trend.

Key Features:

- Adaptive Smoothing: Adjusts its smoothing constant based on market conditions, becoming more sensitive in trending markets and less sensitive in choppy or sideways markets.

- Noise Reduction: Filters out short-term fluctuations, allowing traders to focus on significant price movements.

- Trend Identification: Helps in identifying the direction and strength of the prevailing trend.

Setting Up the Indicators on TradingView

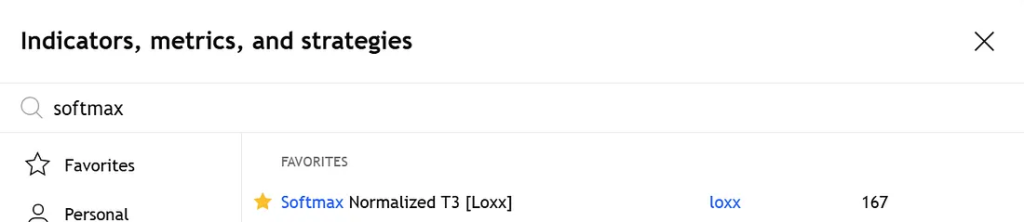

To implement this strategy, follow these steps to add the SAR + Deviation [BigBeluga] and SNT3 indicators to your TradingView chart:

- SAR + Deviation [BigBeluga]:

- Navigate to the indicators tab on TradingView.

- Search for “SAR + Deviation [BigBeluga]” and select it.

- Use the default settings: (0.01, 0.004, 1.5).

2. SNT3 (Kaufman Adaptive Moving Average):

- In the indicators tab, search for “SNT3”.

- Select the indicator with parameters: (Close, 20, 0.7, T3 New, 30, 0.0645, 2, 30).

With these indicators in place, your chart is now equipped to provide clear buy and sell signals.

Trading Strategy: Buy and Sell Setups

Entry Conditions for a Long Position (Buy):

- Bullish Signal from SAR + Deviation: Look for a clear blue upward arrow plotted below the candlesticks, indicating bullish sentiment.

- Price Action Confirmation: Ensure the price candle crosses and closes above the SAR Deviation levels (blue numbers), confirming strong upward momentum.

- SNT3 Confirmation: Verify that the SNT3 indicator switches from red to green and crosses above zero, signaling positive momentum.

When all three conditions align, consider entering a long trade.

Entry Conditions for a Short Position (Sell):

- Bearish Signal from SAR + Deviation: Identify a pink downward arrow plotted above the candles, indicating bearish conditions.

- Price Action Confirmation: The candle should close below the SAR Deviation resistance level (pink numbers), indicating strong downward pressure.

- SNT3 Confirmation: Confirm that the SNT3 indicator turns from green to red and crosses below zero, signaling bearish momentum.

Upon meeting these criteria, consider entering a short trade.

Risk Management: Stop Loss and Take Profit Levels

Stop Loss:

- For Long Positions: Set the stop loss just below the SAR Deviation points.

- For Short Positions: Place the stop loss just above the SAR Deviation points.

Take Profit:

- Aim for a minimum risk-to-reward ratio of 1:1.5 or greater.

- Alternatively, use the SAR + Deviation levels to trail profits and maximize gains.

Key Points for Successful Trading

- Adherence to Signals: Strictly follow the indicators’ signals and avoid letting emotions influence your trades.

- Risk Control: Implement disciplined stop-loss placements to manage risk effectively.

- Confirmation: Always confirm entries with both indicators to enhance accuracy.

Backtesting and Continuous Learning

Before transitioning to live trading, it’s crucial to backtest this strategy extensively on your chosen asset and timeframe. Proper backtesting builds confidence and helps in understanding the strategy’s performance under various market conditions. Additionally, staying updated with market trends and continuously learning will contribute to long-term trading success.

Enhancing Your Trading Knowledge

For those looking to deepen their understanding of advanced technical indicators and trading strategies, consider exploring comprehensive resources and eBooks that delve into these topics. Such materials can provide valuable insights and further refine your trading approach.

Conclusion

Integrating the SAR + Deviation [BigBeluga] and SNT3 indicators into your trading strategy offers a structured approach to navigating the complexities of the cryptocurrency market. By leveraging these tools, you can make informed decisions, manage risk effectively, and enhance your overall trading performance. Remember, consistent success in trading requires discipline, continuous learning, and adherence to a well-defined strategy