Swing Trading isn’t just about buying low and selling high. It’s about timing, momentum, and knowing when to enter with confidence and exit with profits. If you’re tired of vague signals and unreliable indicators, I have something special for you — a swing trading setup that blends trend direction with volume-based confirmation.

Some of the Readers commented about the trade setup for swing trading. I already published an article about how you can make money by swing trading. You can read it here.

In this article, I’m breaking down a powerful combination: the Dragon Flow Trend and the Intraday Intensity Index (IIIX). Together, these tools can guide your swing trades with precision and help you stay on the right side of the market.

🐉 What Is the Dragon Flow Trend?

The Dragon Flow Trend is a custom band-style indicator that overlays on price charts like a moving average envelope. It visually represents a dynamic price channel formed by averaging past price movements and expanding it using standard deviation or fixed points.

🟦 Why It’s Useful:

- It identifies the trend direction clearly.

- You can instantly spot when the price is breaking out of a zone.

- It acts as dynamic support and resistance during consolidations.

🚦 Key Zones of the Dragon Flow:

- Upper Band Breakout: Bullish territory. A breakout above the top band often signals a new leg up.

- Lower Band Breakdown: Bearish territory. A close below the bottom band means sellers are in control.

- Inside Bands: No-trade zone or range-bound market.

This tool alone can tell you whether to stay out or step in — but that’s not enough. We need confirmation, and that’s where the Intraday Intensity Index comes in.

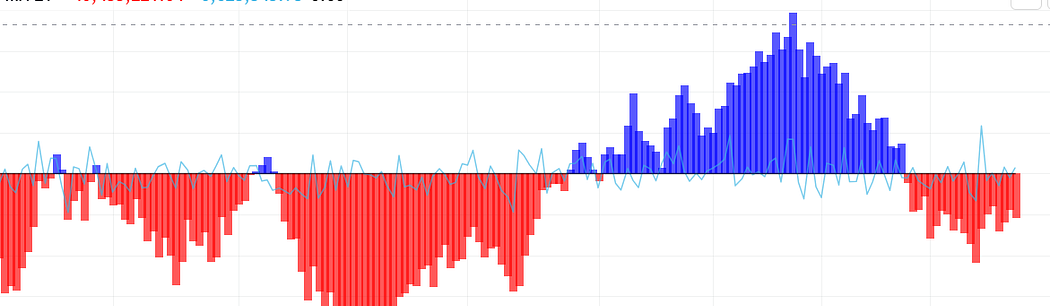

💥 Meet the Intraday Intensity Index (IIIX)

The IIIX is a volume-based oscillator that measures buying and selling pressure in the market. It works a bit like the On-Balance Volume (OBV), but it’s more sensitive to where the price closes within the day’s range, which gives it a psychological edge.

🔍 How It Works:

- If the stock closes near the high of the day, it means accumulation.

- If it closes near the low of the day, it suggests distribution.

- Combine this with the volume, and you get IIIX readings.

📊 How to Read It:

- Positive IIIX values (Blue Bars): Buying pressure (bullish).

- Negative IIIX values (Red Bars): Selling pressure (bearish).

- The height of the bar reflects the intensity of volume action.

- When the IIIX bars shift color (from red to blue or vice versa), momentum is shifting.

🎯 Why Combine Dragon Flow + IIIX?

Because trend + volume = conviction.

The Dragon Flow tells you where the trend is heading. The IIIX tells you who’s pushing that trend — buyers or sellers. Together, they provide a crystal-clear roadmap for your swing trades.

Think of it like this:

- The Dragon Flow gives you the weather forecast.

- The IIIX tells you how strong the wind is blowing in that direction.

Below are my new ebooks.

If you’ve ever felt lost in the chaos of market moves, it’s time to bring structure to your strategy. My new ebook, CPR MASTER CLASS, breaks down one of the most powerful tools in price action trading — Central Pivot Range — and shows you exactly how to trade with confidence, clarity, and consistency.

✅ Learn CPR, Virgin CPR, Camarilla, Volume, VWAP, and more

✅ Includes real chart examples, setups, and TradingView guides

✅ Instant download, lifetime access👉 Grab your copy now on Gumroad:

🚀 Ready to Supercharge Your Trading? 📈

If you’re tired of guesswork and want to trade confidently using advanced indicators that actually work, my ebook “Advanced Technical Indicators for Your Trading Journey” is exactly what you need!

👉 Click here to grab your copy on Gumroad now! 👈

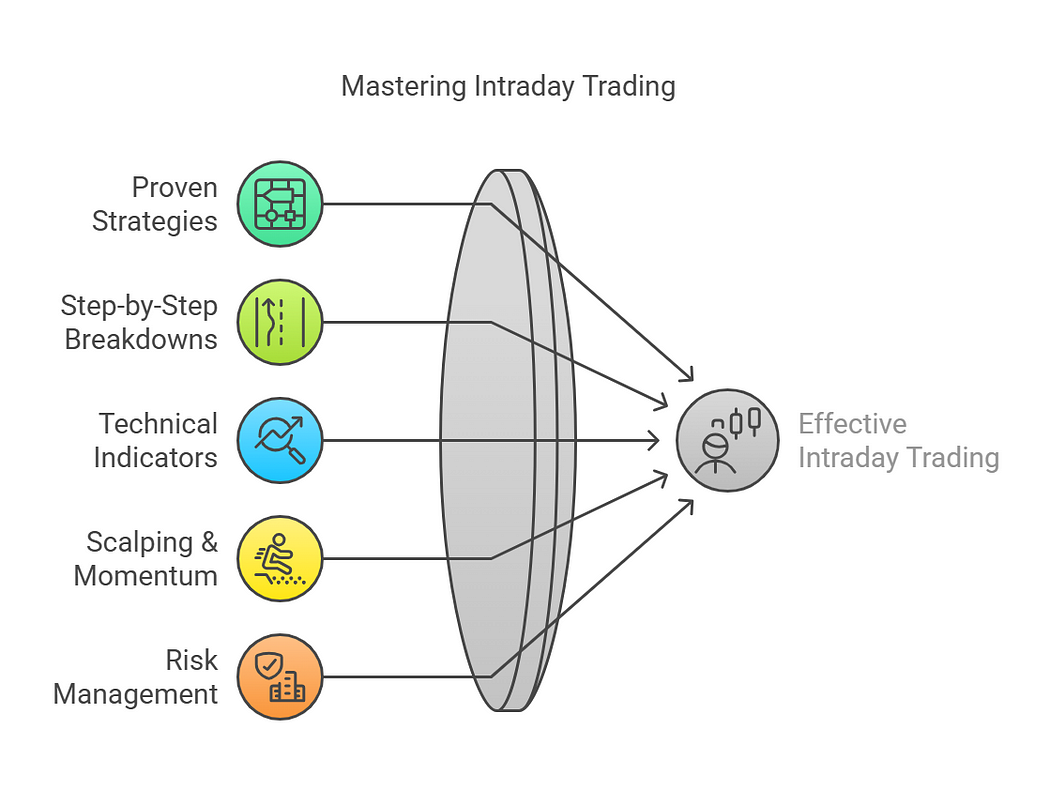

BUY NOW 25 Intraday Trading Strategies in 2025. 🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!” ‘ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

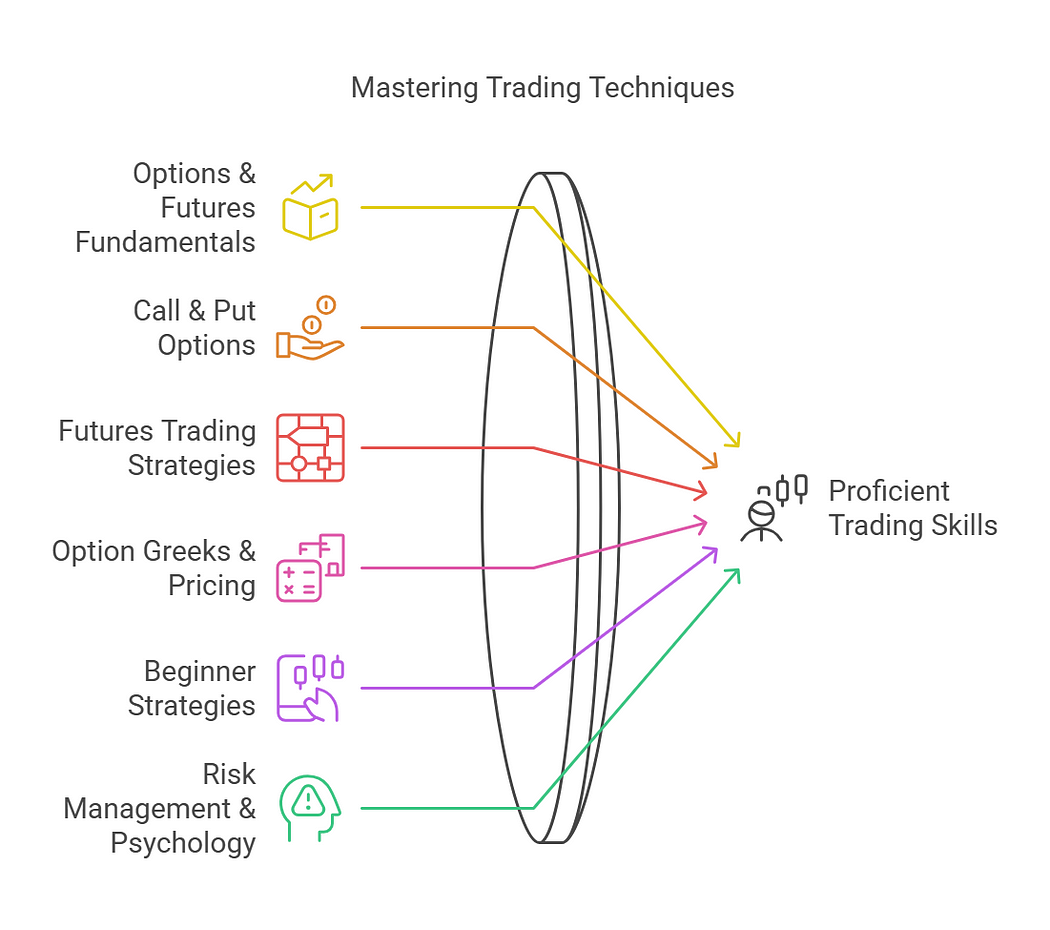

BUY NOW OPTIONS AND FUTURES FOR BEGINNERS 2025

‘📗 ’15 Intraday Indicators’ — Master the most powerful technical indicators for precision trading. Learn how to spot high-probability setups, confirm trends, and optimize your entries and exits like a pro.

‘Stock Market for Beginners’ — Your ultimate guide to understanding the stock market from scratch! Learn essential terms, beginner-friendly strategies, and how to grow your wealth — no prior experience is needed

✅ Buy Setup: Entering a Swing Trade to the Long Side

Let’s break this into clear steps.

🟢 Entry Conditions:

- Price closes above the upper band of the Dragon Flow Trend.

- The IIIX turns blue (positive) and shows rising bars, indicating growing buying pressure.

- Bonus: The breakout candle should ideally have above-average volume and a strong green body.

- Look for this breakout from a consolidation zone or pullback.

🛑 Stop Loss:

- Place it below the middle band of the Dragon Flow channel (the base of the current move).

- You could also use the low of the breakout candle.

🎯 Target:

- First target: Recent swing high or Fibonacci extension (1.618 level works well).

- Second target: Trail stop-loss and ride the trend until the price closes back inside the Dragon Flow band.

🚨 Sell Setup: Shorting With Confidence

Here’s how you set up a swing short trade using the same logic.

🔴 Entry Conditions:

- Price closes below the lower band of the Dragon Flow.

- IIIX turns red (negative) with increasing red bars — volume confirms bearish momentum.

- Breakdown should follow a sideways zone or a failed bounce.

- The breakdown candle should ideally be a strong red candle.

🛑 Stop Loss:

- Above the mid-band of the Dragon Flow or the high of the breakdown candle.

🎯 Target:

- First target: Recent swing low or 1:2 risk-reward level.

- Second target: Trail stop loss until the price closes above the mid-band or IIIX turns positive.

📊 More Charts

📈 How to Add These Indicators on TradingView

Here’s how you can set this up:

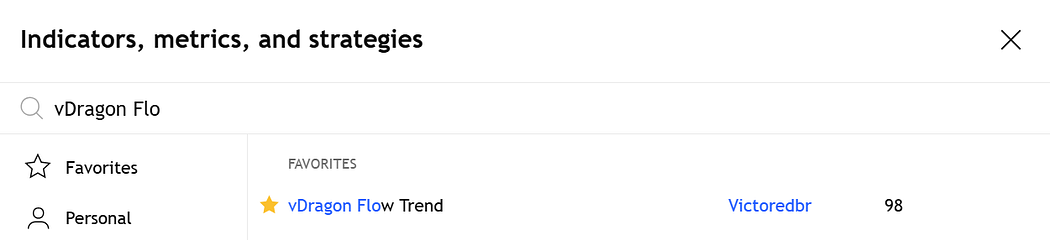

➕ Dragon Flow Trend:

- Open your TradingView chart.

- Click on Indicators.

- Search “Dragon Flow Trend”.

- Add the one with

(50, 50, 50)or customize to match.

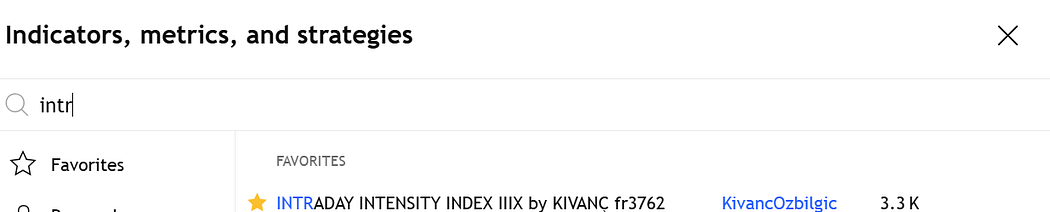

➕ Intraday Intensity Index (IIIX):

- Again, open Indicators.

- Search for “Intraday Intensity Index”.

- Choose the version that shows histogram bars (blue/red) for clarity.

🧠 Pro Tips to Use This Strategy Effectively

1. Avoid Traps Inside the Band

Don’t trade when the price is inside the Dragon Flow band unless a breakout is forming. That’s chop zone — stay safe.

2. Look for Confluence

Combine this setup with support/resistance zones, Fibonacci levels, or RSI divergence for extra strength.

3. Volume Is Key

Volume is your truth-teller. Always check if a breakout or breakdown happens with strong volume to avoid false signals.

4. Timeframe Matters

This strategy works best on daily or 4H charts. Lower timeframes can produce noise.

5. Risk Management Is Everything

Stick to 1–2% risk per trade. A good strategy with bad risk control still leads to losses.

📚 Real-World Use Case

Let’s say you’re swing trading mid-cap stocks like NTPC, BHEL, or BEL. These are known for their trending moves.

Here’s a potential plan:

- Every weekend, scan your top 20 watchlist stocks using Dragon Flow + IIIX.

- Note the ones nearing a band breakout with rising IIIX.

- Set alerts on TradingView for breakout/breakdown levels.

- When price breaks + IIIX confirms, enter with a stop and fixed target.

- Exit partially at the target, then trail the rest for bigger profits.

⚖️ Pros & Cons of This Strategy

✅ Pros:

- High probability signals

- Visually clear entries and exits

- Volume-based confirmation = strong filter

- Great for swing traders who don’t want to watch charts all day

❌ Cons:

- Doesn’t work well in highly choppy or sideways markets

- Needs patience to wait for ideal conditions

- Lagging signals if you’re too late in the move

👊 Final Thoughts

If you’ve been struggling with inconsistent swing trades, the Dragon Flow + IIIX combo might be the missing link. It’s simple, visual, and backed by price and volume logic.

Remember, no strategy is perfect, but a great one improves your probability of winning trades while keeping risks in check. Start using this setup on a demo account, backtest it, tweak it to your style, and then deploy it in your live trading plan.

Happy swing trading!