Trading doesn’t need to be complicated. Some of the most powerful strategies are often the simplest — combining clear rules with clean visual confirmation. We don’t need twenty indicators pointing in different directions. What we need is structure, patience, and discipline.

In this article, I’ll walk you through one of the most humanized, touch-worthy strategies I’ve used: The Top & Line Strategy. If you’ve ever stared at endless candles on your chart, feeling lost, this method will feel like a breath of fresh air.

1. The Philosophy Behind This Strategy

Markets are like conversations. Sometimes they whisper, sometimes they shout. The goal of this setup is to listen when the market hints that it has reached an extreme — a top or a bottom.

We’re not here to predict the future. Instead, we’re recognizing the market’s own signals when price touches a key level and confirms a reversal. This strategy rests on two timeless truths:

- Price respects levels.

- Reversals always leave footprints.

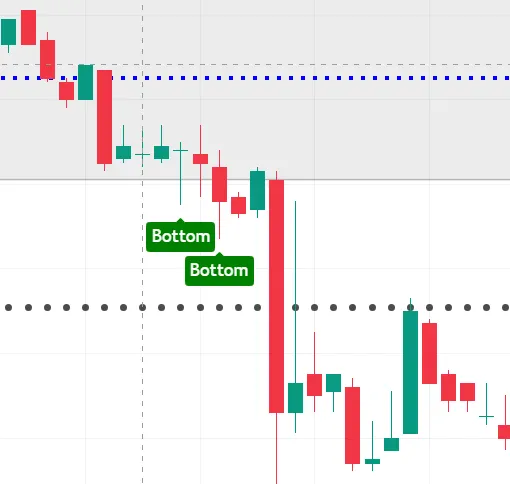

When a candle interacts with a critical line (resistance for a sell, support for a buy) and a Top or Bottom signal appears, that’s our green light — or in the case of a short, a clear red one.

2. Tools You Need

- Candlestick Chart: Use a simple 5-minute or 15-minute chart. Nothing fancy.

- Easy System v1 (TradingView Script): This provides the Top/Bottom signals.

The magic happens when the price touches these lines and the signal appears. That’s where clarity enters the picture.

3. The Sell Condition (Short Entry)

Picture this: the market has been climbing, optimism is everywhere, and traders think the rally will never stop. Then, price taps resistance. At that very moment, a Top signal flashes.

If that candle closes red, sellers are stepping in. That’s your short entry.

Rules Recap:

- Candle must touch the resistance line.

- Candle must close red.

- A Top signal must appear.

- Enter the short trade at the candle’s close.

This setup captures exhaustion. When buyers fail at resistance, sellers step in quickly — often leading to sharp, fast drops.

4. The Buy Condition (Long Entry)

Now flip the picture. Price has been falling, fear spreads, and traders start panicking. Then, the candle taps support. At that moment, a Bottom signal flashes, and the candle closes green.

That’s not random. It’s buyers defending the level.

Rules Recap:

- Candle must touch the support line.

- Candle must close green.

- A Bottom signal must appear.

- Enter the long trade at the candle’s close.

Support zones are areas where demand outweighs supply. When confirmed with signals, they often spark strong bounces.

5. Stop Loss and Take Profit

Even the best strategy needs boundaries. Without them, discipline breaks down.

- Stop Loss for Shorts: Place just above resistance or the Top candle.

- Stop Loss for Longs: Place just below support or the Bottom candle.

- Take Profit:

- Conservative: 1:2 Risk-Reward ratio.

- Aggressive: Trail stop loss as price moves in your favor.

6. Why This Strategy

Many strategies feel mechanical — robotic rules that disconnect you from the market. This one feels alive.

Because it makes you see and feel the market’s rhythm. You’re not blindly obeying an indicator. You’re watching price touch a level, noticing the candle’s color shift, and respecting the signal in real time.

It’s almost like catching the market mid-step as it changes direction. That human touch makes trading engaging and confidence-building.

7. Avoiding False Signals

No system is perfect. Here’s how to filter weaker trades:

- Ignore signals if the candle doesn’t touch a line.

- Trade only during high-volume sessions (London, New York, or overlaps for crypto).

- Skip signals in choppy sideways ranges.

- Look for confluence: multiple Tops or Bottoms at the same line strengthen the signal.

8. Building Confidence Through Practice

The strategy is simple to backtest. Scroll back through your charts and check:

- Did a red candle touch resistance when a Top appeared?

- Did a green candle touch support when a Bottom appeared?

You’ll notice how often the market respects these signals. Repetition builds confidence — and confidence reduces hesitation.

9. The Psychological Edge

Trading isn’t just technical; it’s deeply psychological.

- When you see a Top signal at resistance, you know late buyers are trapped. You’re aligning with smart money.

- When you see a Bottom signal at support, you know fear has peaked, and buyers are stepping in.

This clarity reduces second-guessing, lowers overtrading, and gives you a mindset edge over the crowd.

10. Final Thoughts

The Top & Line Strategy isn’t about predicting where the market will go. It’s about listening when the market itself whispers: “I’m turning.”

By combining line levels, Top/Bottom signals, and simple candle confirmations, you strip away noise and trade with focus.

It’s not magic. It’s not flawless. But it gives you something priceless: structure, discipline, and confidence. And in trading, those three qualities often make the difference between endless chasing and consistent progress.