If you are looking for a trading strategy to start a new trading journey in 2025, congratulations you are in the right place. Whether you are trading in forex, crypto, options, or stocks you need a trading setup. In this article, I will explain the 4 intraday trading strategies you should practice in 2025.

It’s your choice which trading strategy is best suited for your trading style.

Key points

- Trading involves risk. Whatever strategy you are practising you must keep strict stop loss.

- If you choose a scalping style of trading you should close the trade within 10 minutes.

- Choose the risk you can afford to lose

- Practice your setup in different time frames.

1. CPR + Supertrend Trading Strategy

The central pivot range is one of my favorite Technical Indicator. I have already published an article about the indicator CPR. You can add the CPR indicator in the trading view platform.

How to Add the Indicators

- Open TradingView.

- Search for the CPR Indicator and add it to your chart.

3. Search for Supertrend and add it with default settings.

Buy Entry Conditions

- The price should be above CPR

- Supertrend gives a Buy signal

- A bullish candle should break above the support or resistance line

- A bullish candle forms near the CPR zone.

Entry: Enter a long trade when a bullish candle closes above CPR with Supertrend confirming the uptrend.

Stop-Loss: Below the BC (Bottom CPR level) or recent swing low.

Target: 1:2 risk-reward ratio or the next resistance level (R1, R2).

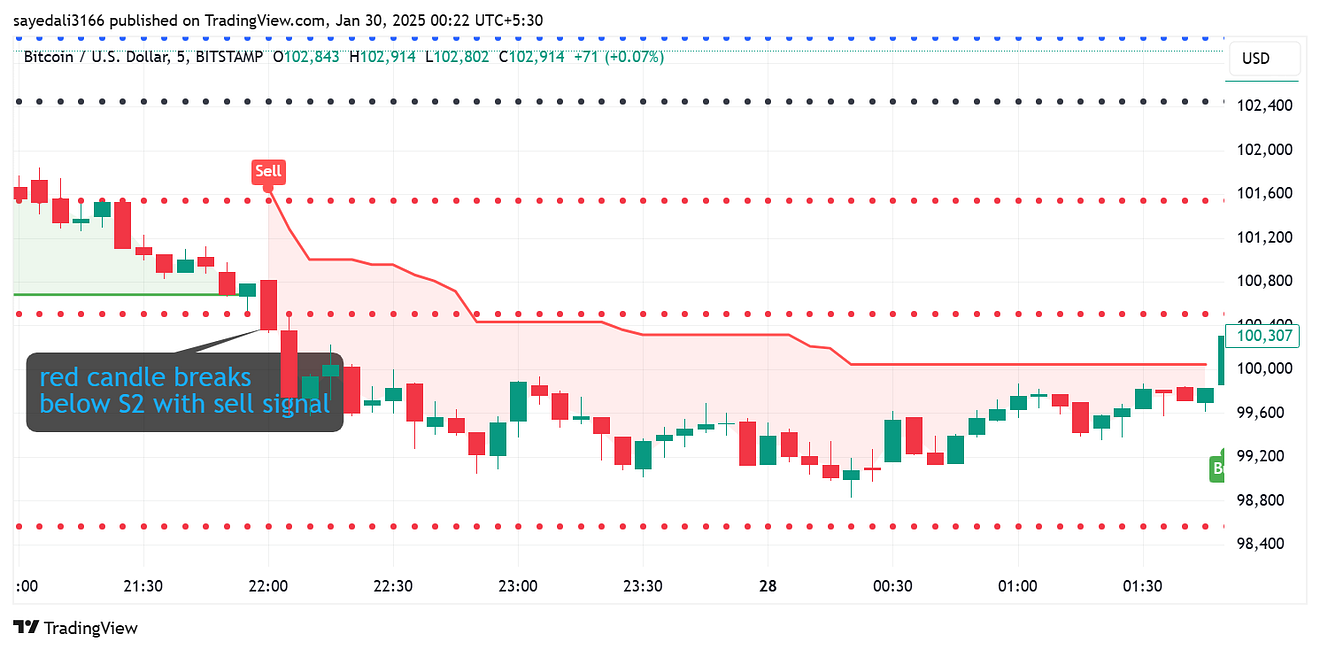

Sell Entry Conditions

- The price is below the CPR

- Supertrend gives a Sell signal

- A bearish candle should break below the support or resistance line

- A bearish candle forms near the CPR zone.

Caution:

This strategy does not give you a 100% success rate. This strategy also gives false signals. Trade and practice on a demo account.

Ready to transform your financial future and dominate the stock market? Whether you’re a beginner looking to take your first steps or a trader hungry for proven strategies, I’ve got you covered!

📘 ‘Stock Market for Beginners’ is your ultimate guide to understanding the market from scratch. Learn essential terms, beginner-friendly strategies, and how to start growing your wealth — no experience needed!

📗 ’25 Intraday Strategies in 2025′ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!”

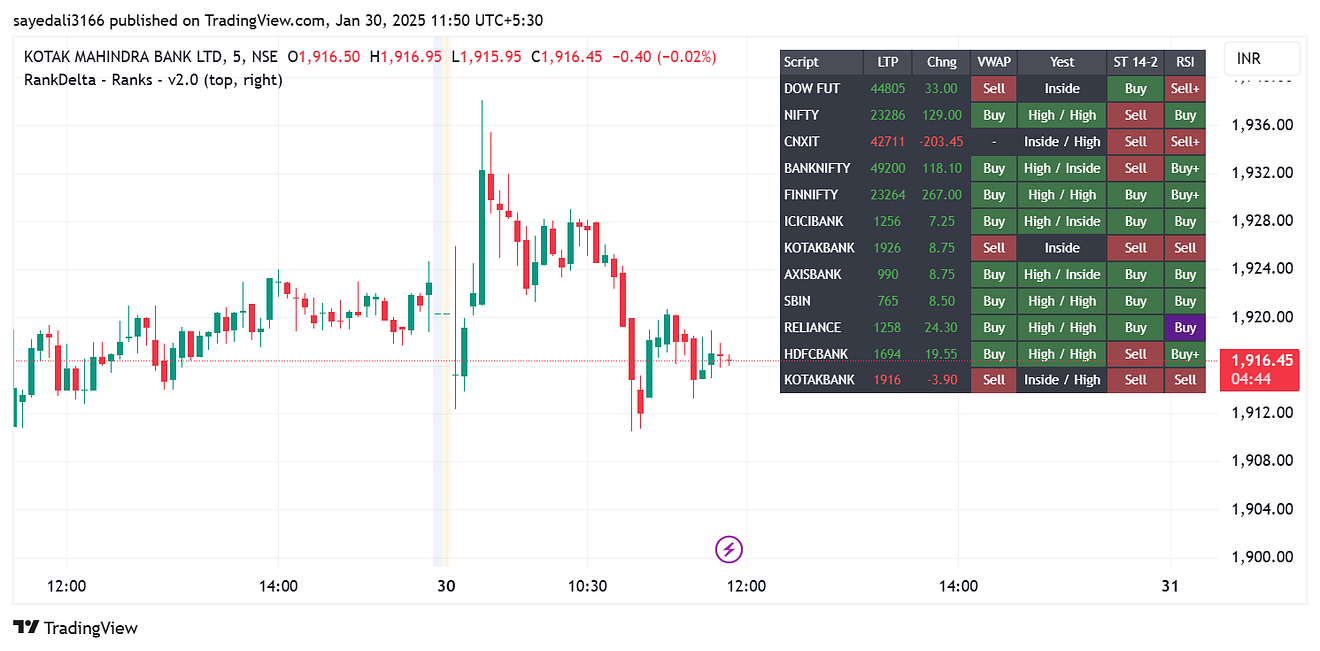

2. Rank delta Indicator strategy

Imagine a dashboard showing your favorite stocks or indexes or whatever asset-corresponding technical indicators signal. Yes, this indicator is best for option traders.

How to add the indicators

Go to the Tradingview platform and search for “rank delta indicator” and add it to your chart.

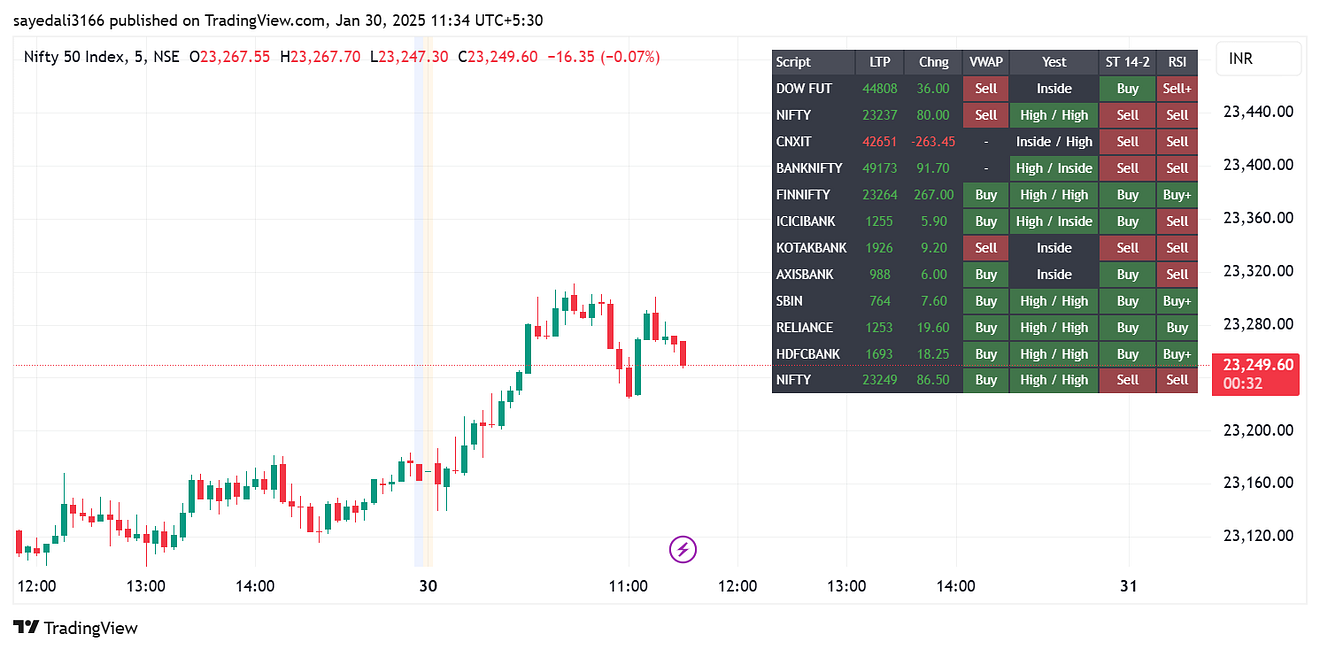

after adding the indicator your chart looks like the below image

You can analyze each stock performance based on the technical indicator on a simple dashboard

Buy conditions

- Any of the three indicators should give you a buy signal

- A bullish green candle can confirm your entry.

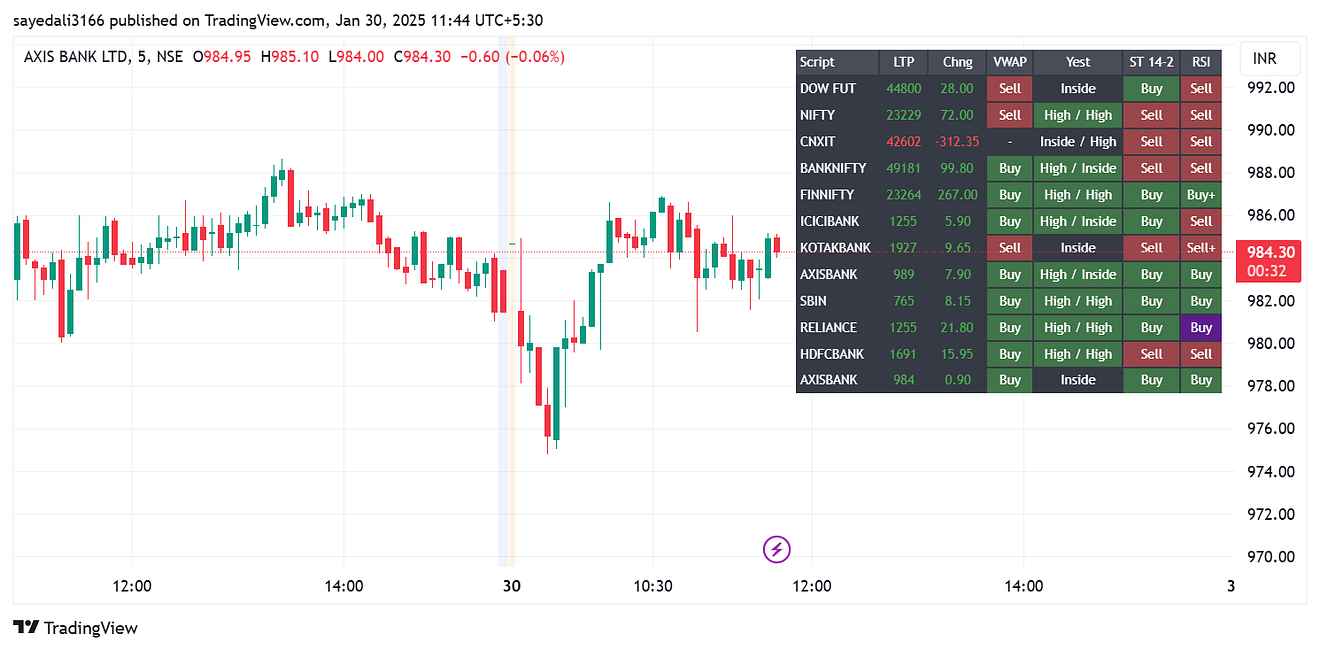

Here in the above Axis bank,SBIN, reliance shows buy on three indicator.

In Axis Bank, you can consider a buy entry.

Sell Conditions

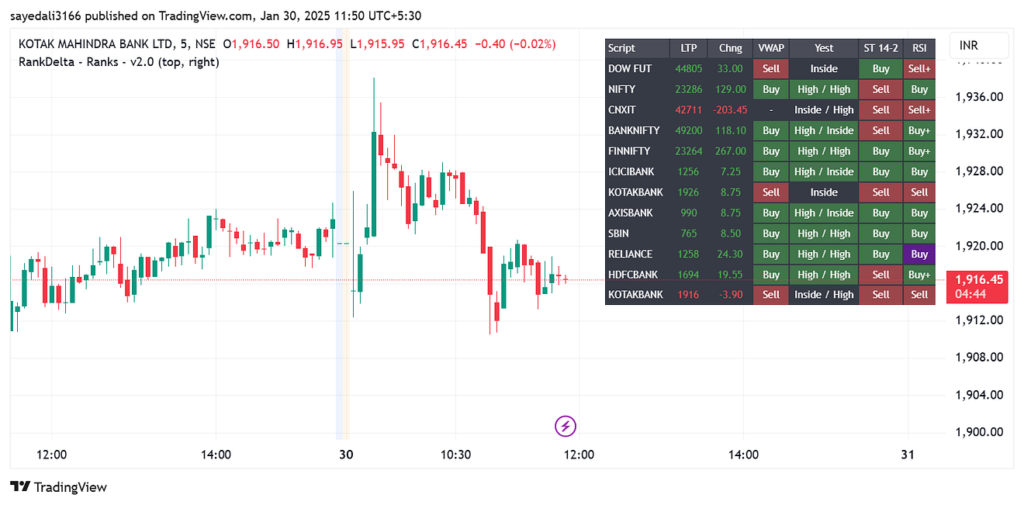

- Any of the three indicators should give you a sell signal

- A bearish candle can confirm your entry.

In the above image, Kotak Bank shows a sell signal. Let’s look at the Kotak bank chart

Kotak Bank is falling. you can go for a short entry.

This indicator is best for options trading in nifty and bank nifty.

3. Eveningstar + Morningstar strategy

This strategy is a candlestick strategy that works on any asset.

Let’s get into the strategy

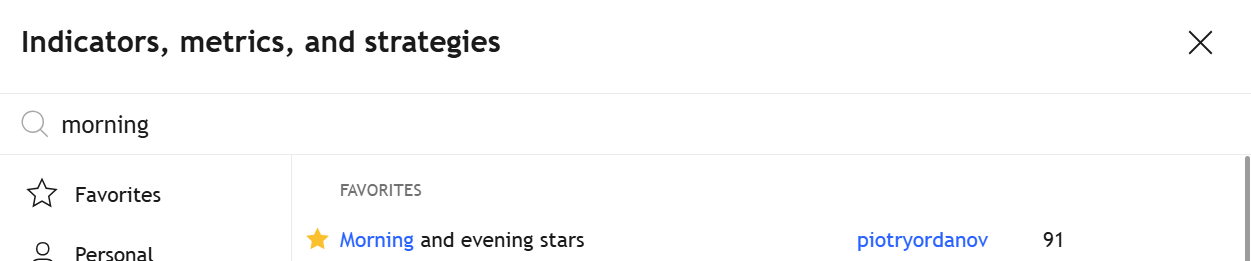

Go to Tradingview search for morning and evening star and add it to your chart.

Buy conditions

- look for the morning star signal on the green candle

- Buy entry confirmation on support

Sell Conditions

- look for the evening star signal on the red candle

- sell entry confirmation on the resistance line.

4. MACD+ EWO

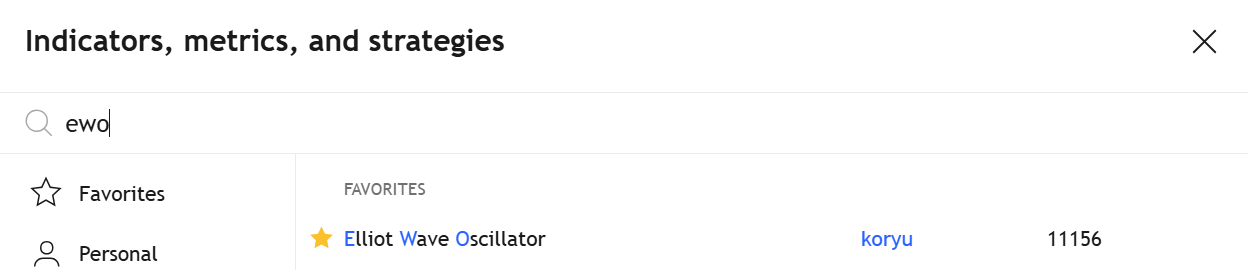

This strategy combines macd indicator with the Elliot wave oscillator. add both indicators from tradingview

Buy Conditions (Long Entry)

- MACD Confirmation:

- The MACD line crosses above the Signal line.

- MACD histogram turns positive (above zero).

2. EWO Confirmation:

- The EWO histogram is positive (above zero) and rising.

- The latest bar is higher than the previous one, confirming momentum.

3. Additional Confirmation (Optional but Recommended):

- The price is above the 50 EMA (indicating an uptrend).

- Volume increases to support the move.

Exit Buy:

- Exit when the MACD line crosses below the Signal line OR

- The EWO histogram starts declining and turns negative.

Sell Conditions (Short Entry)

- MACD Confirmation:

- The MACD line crosses below the Signal line.

- MACD histogram turns negative (below zero).

2. EWO Confirmation:

- The EWO histogram is negative (below zero) and decreasing.

- The latest bar is lower than the previous one, confirming momentum.

3. Additional Confirmation (Optional but Recommended):

- The price is below the 50 EMA (indicating a downtrend).

- Volume increases to support the move.

Exit Sell:

- Exit when the MACD line crosses above the Signal line OR

- The EWO histogram starts rising and turns positive.

Mastering trading strategies is crucial for success in 2025. Whether you prefer price action techniques like the Evening Star & Morning Star strategy or rely on indicators like CPR + Supertrend or MACD + EWO, the key is to find a setup that aligns with your trading style. Remember, no strategy guarantees 100% success — risk management and continuous practice are essential.

Before applying these strategies in live markets, test them on a demo account and refine your entries and exits. Stick to a solid risk-reward ratio, and always trade with discipline.

If you found this guide helpful, explore more of my trading strategies on Medium Happy trading! 🚀