The Iron Bot V3 + MACD Scalping Strategy

If you are looking for an effective intraday strategy for 2025 then this article is for you. This setup is perfect for beginners and experienced traders alike. This setup is best for scalpers. Combining the Iron Bot V3 indicator with the MACD (Moving Average Convergence Divergence), this strategy offers reliable entry and exit signals based on trend direction, momentum, and market strength.

“Ready to transform your financial future and dominate the stock market? Whether you’re a beginner looking to take your first steps or a trader hungry for proven strategies, I’ve got you covered!

📘 ‘Stock Market for Beginners’ is your ultimate guide to understanding the market from scratch. Learn essential terms, beginner-friendly strategies, and how to start growing your wealth — no experience needed!

📗 ’25 Intraday Strategies in 2025‘ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!”

How to Add the Indicators

- Log into your TradingView account.

- Open a chart of your preferred stock or forex pair.

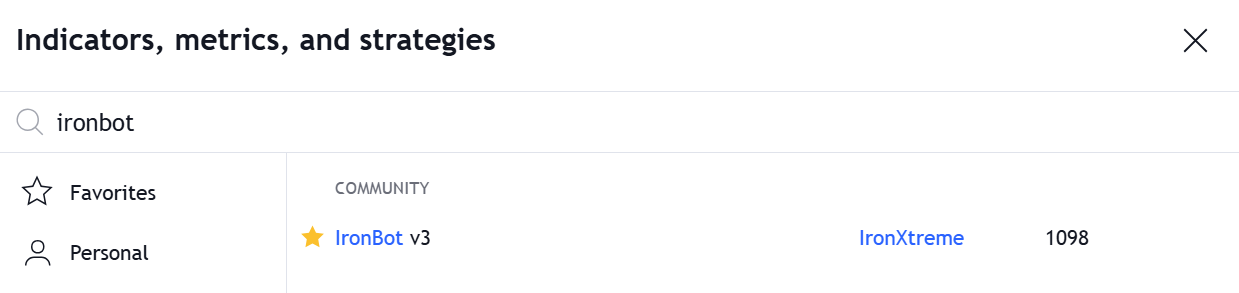

- Search for “Iron Bot V3” in the indicators section and apply it to the chart.

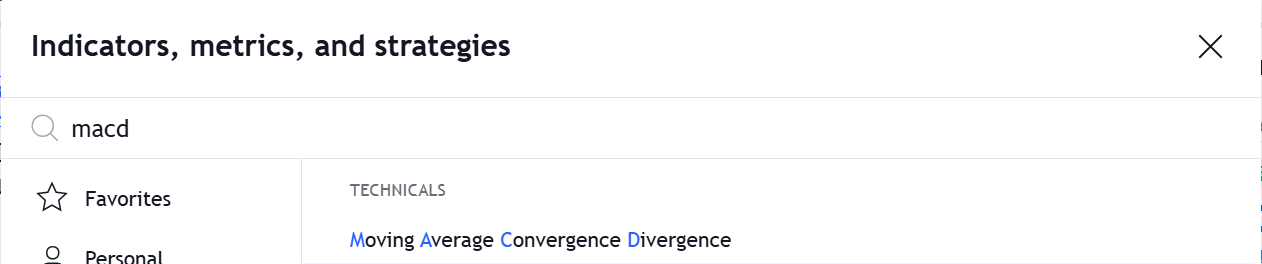

4. Search for “MACD” in the indicators section and add it to the chart.

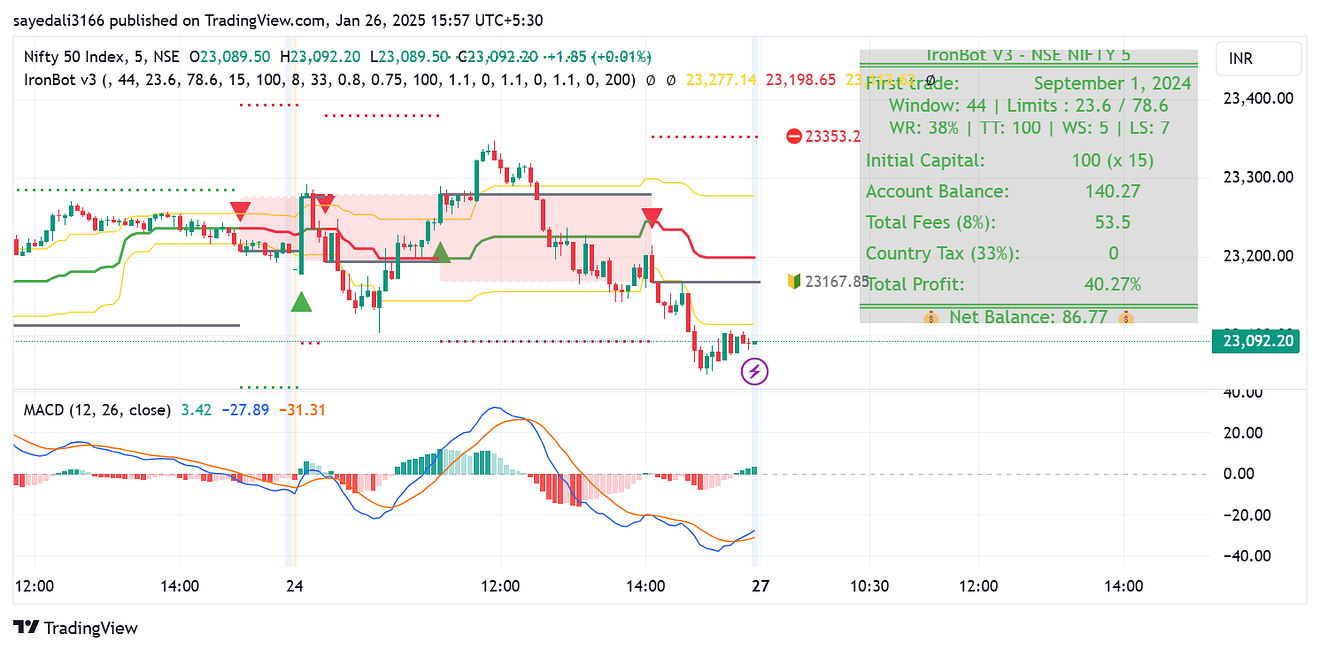

After adding both indicators your chart looks like the below image.

Buy Entry Conditions

- The Iron Bot V3 indicator provides a Buy Signal Arrow.

- The market forms bullish candles as confirmation.

- The green candle should cross above the iron bot indicator yellow line

- The MACD Line crosses above the Signal Line, indicating upward momentum.

Trade Execution:

- Place a Buy Order when all conditions are met.

- Set your Stop Loss at the lower line of the Iron Bot V3 indicator.

- Use a Risk-to-Reward Ratio of 1:1 or 1:1.5, based on your trading preference.

Sell Entry Conditions

- The Iron Bot V3 indicator provides a Sell Arrow Signal.

- The market forms bearish candles as confirmation.

- The ed candle should cross below the iron bot indicator yellow line

- The MACD Line crosses below the Signal Line, indicating downward momentum.

Trade Execution:

- Place a Sell Order when all conditions are met.

- Set your Stop Loss at the higher line of the Iron Bot V3 indicator.

- Use a Risk-to-Reward Ratio of 1:1 or 1:1.5, based on your trading preference.

Key Points

- Use this strategy on the 5-minute chart for assets like Amazon (US Stock) or other high-liquidity instruments.

- Both indicators must align before entering a trade.

- Be disciplined with your stop loss and maintain the defined risk-to-reward ratio for consistency.

False signals

You should avoid the false signals

Important Notes

- Backtest the strategy thoroughly before trading with real money.

- Ensure proper risk management, avoiding over-leveraging your positions.

- The strategy performs best in trending markets; avoid it during choppy or range-bound conditions.

Conclusion

By combining the Iron Bot V3 indicator with the MACD, this strategy offers a straightforward approach to scalping and day trading. Stick to the entry and exit rules, manage your risks, and stay consistent for better trading results. For stop loss and target, you can choose the indicator CPR. I already published an article about it you can read it here