Are you frustrated with laggy indicators and false signals draining your trading confidence?

You’re not alone — and the solution is simpler than you think.

Leading indicators, not lagging ones, are the secret to timely entries, strong trend confirmation, and better trading consistency. Today, I’ll break down a powerful intraday strategy combining two real-time tools: SuperTrend and Trading The Channel (TASC 2025.05).

This method is designed for fast, reliable trades — ideal for highly volatile assets like Natural Gas Futures, crypto, indices, and large-cap stocks.

Why This Strategy Stands Out

Whether you’re a scalper or a short-term swing trader, this system helps you:

✅ Catch early entries

✅ Confirm the real trend strength

✅ Avoid getting trapped in sideways chop

✅ Lock in profits smartly with tight risk control

📢 Want more free strategies? Explore my website: TradeTalksHub.com

📘 Want More Like This? Explore My eBooks 👇

If you found this strategy helpful, imagine having 25 more like this — all tested, beginner-friendly, and powerful.

🔥 New Releases on Gumroad:

- ✅ 25 Intraday Trading Strategies in 2025

- ✅ Options and Futures for Beginners 2025

- ✅ 15 Intraday Trading Indicators

- ✅ Stock Market for Beginners — Your complete guide to stock investing from scratch

📈 Chart Setup Overview

We’ll be using two core indicators in this setup:

1. SuperTrend (Settings: 10, hl2, 3)

- A trend-following overlay that turns green in uptrends and red in downtrends.

- Entry is triggered when price crosses and closes beyond the SuperTrend line.

2. Trading The Channel [TASC 2025.05]

- A hybrid trend-momentum oscillator inspired by TASC magazine.

- Helps you confirm breakouts, avoid false signals, and spot momentum shifts.

- Color coding: Blue for bullish, Orange for bearish.

- Bonus: Arrows appear for trend confirmation.

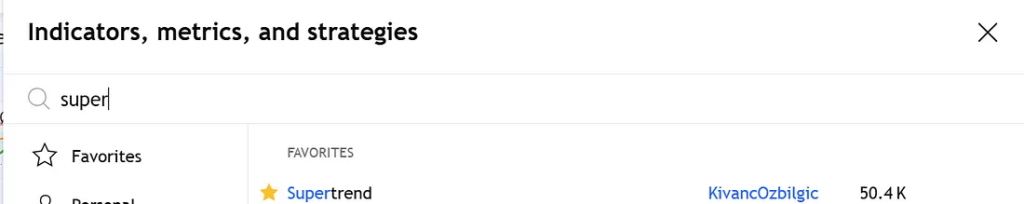

🛠️ How to Add These Indicators on TradingView

- Open TradingView.

- Click on Indicators.

- Search for:

- “SuperTrend” (use the built-in version, set to 10, hl2, 3).

4. “Trading The Channel” (community scripts or TASC library).

5. Set your chart timeframe to 5-Min or 15-Min.

🧠 How the Strategy Works

The power of this strategy lies in dual confirmation:

SuperTrend for trend direction + Trading The Channel for momentum validation.

🟢 Long Setup (Buy Conditions)

✅ SuperTrend turns Green with a Buy Label.

✅ Green candle closes above the Trading Channel line.

✅ Trading Channel line flips orange with a Green Up Arrow.

✅ Bonus: Channel line rising above zero.

🎯 Entry: Enter at the candle close when all conditions align.

🛑 Stop Loss: Below the SuperTrend line or recent swing low.

🏁 Target Profit: 1.5x to 2x your risk — or exit when SuperTrend flips Red or Channel turns Orange.

🔴 Short Setup (Sell Conditions)

✅ SuperTrend turns Red with a Sell Label.

✅ Red candle closes below the SuperTrend line.

✅ Trading Channel line flips blue with a Red Down Arrow.

✅ Bonus: Channel line falling below zero.

🎯 Entry: Enter at the candle close when all conditions align.

🛑 Stop Loss: Above the SuperTrend resistance or last swing high.

🏁 Target Profit: 1.5x to 2x your risk — or exit when SuperTrend flips Green or Channel turns Blue.

💡 Pro Tips for Maximum Accuracy

🔹 Time Your Trades:

Only trade during high-volatility hours like London Open, NY Open, or after important news releases. Avoid dead zones.

🔹 Avoid Ranging Markets:

If SuperTrend flips too often or the Channel line flattens, skip the trade.

🔹 Confluence with Support/Resistance:

Mark key levels manually. Breakouts through these levels add extra strength to your setup.

🔹 Add EMA 20 and EMA 50:

- EMA 20 > EMA 50 → Prefer Buy Setups.

- EMA 20 < EMA 50 → Prefer Sell Setups.

📉 When Not to Use This Strategy

- SuperTrend flips rapidly = sideways market.

- Channel oscillator stays flat = no momentum.

- Extremely low volume periods.

- Right before big news events (EIA, Fed Meetings, etc.).

📚 FAQ: Frequently Asked Questions

❓ Best Assets for This Strategy?

Crypto (BTC, ETH), Commodities (Natural Gas, Oil), Indices (Nifty, Nasdaq), Large-cap stocks.

❓ Best Timeframe?

- 5-Min and 15-Min for scalping.

- 30-Min for short-term swing trades.

❓ Expected Trades Per Day?

On active sessions, expect 3–6 high-probability trades.

❓ Can It Be Used for Options?

Absolutely! Ideal for directional intraday or weekly options trading.

🔧 Quick Tools & Settings Recap

🗣️ Final Thoughts

The SuperTrend + Trading The Channel strategy is a responsive, low-risk, high-reward system that offers clarity without overcomplication.

If you’re serious about improving your intraday trading, this setup deserves a spot in your playbook.

✅ Remember: Discipline and patience > Any indicator.

Always backtest first, trade small initially, and grow with consistency.

🔗 Stay Connected

- 🚀 More free strategies at TradeTalksHub.com

- ✍️ Follow me on Medium for deep-dive trading content

- ☕ Support my work: Buy Me a Coffee

⚠️ Disclaimer

This article is for educational purposes only. Trading involves significant risk and is not suitable for all investors. Always consult a licensed financial advisor before making trading decisions.