Hello Traders,

In this article, I will explain a simple day trading strategy for beginners. New traders may have heard about Bollinger bands. In this article, I am explaining the Bollinger band strategy by combining it with Pivot Points Indicator. If you’re looking for a reliable and efficient scalping strategy, this setup is perfect for you.

Ready to transform your financial future and dominate the stock market? Whether you’re a beginner looking to take your first steps or a trader hungry for proven strategies, I’ve got you covered!

📘 ‘Stock Market for Beginners’ is your ultimate guide to understanding the market from scratch. Learn essential terms, beginner-friendly strategies, and how to start growing your wealth — no experience needed!

📗 ’25 Intraday Strategies in 2025′ is packed with powerful, easy-to-follow setups designed to maximize your trading profits this year. From quick scalps to trend-following techniques, this book gives you the edge to crush the markets like a pro.

🚀 Don’t miss this opportunity to supercharge your financial journey. Get both ebooks now on Gumroad and start building your path to success today!”

How to add the indicators

To use the indicators you need a tardingview account.

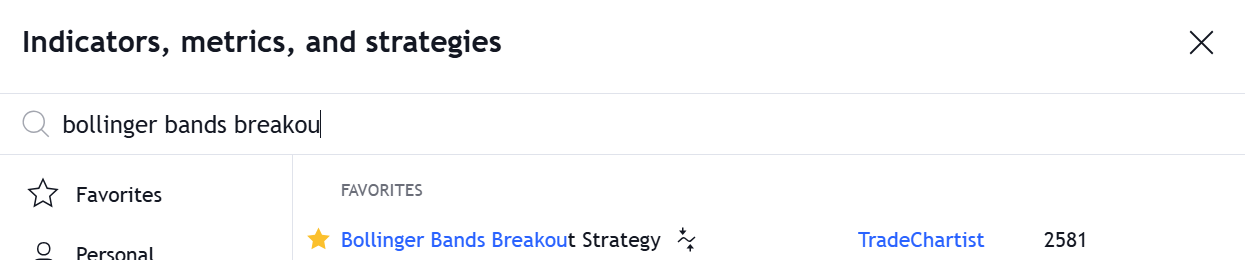

In trading view select your asset search for “Bollinger bands breakout strategy” and add it to your chart.

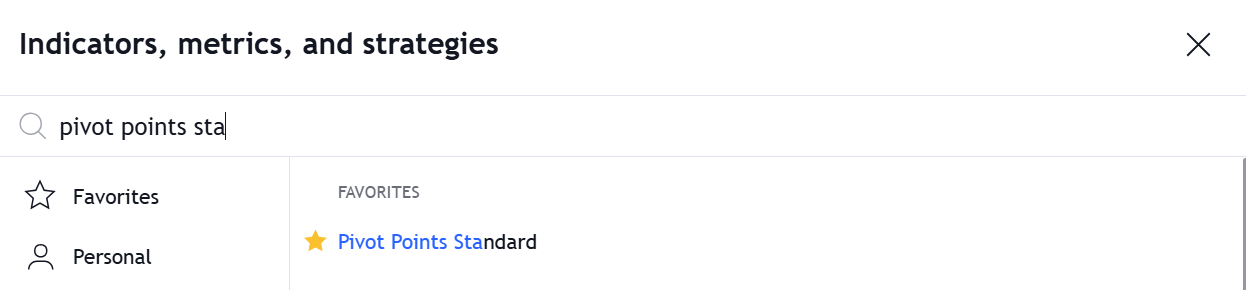

Next, you need to add the Pivot Points indicator.

Search “pivot points” and add it to your chart.

It’s done.

Let’s get into the strategy

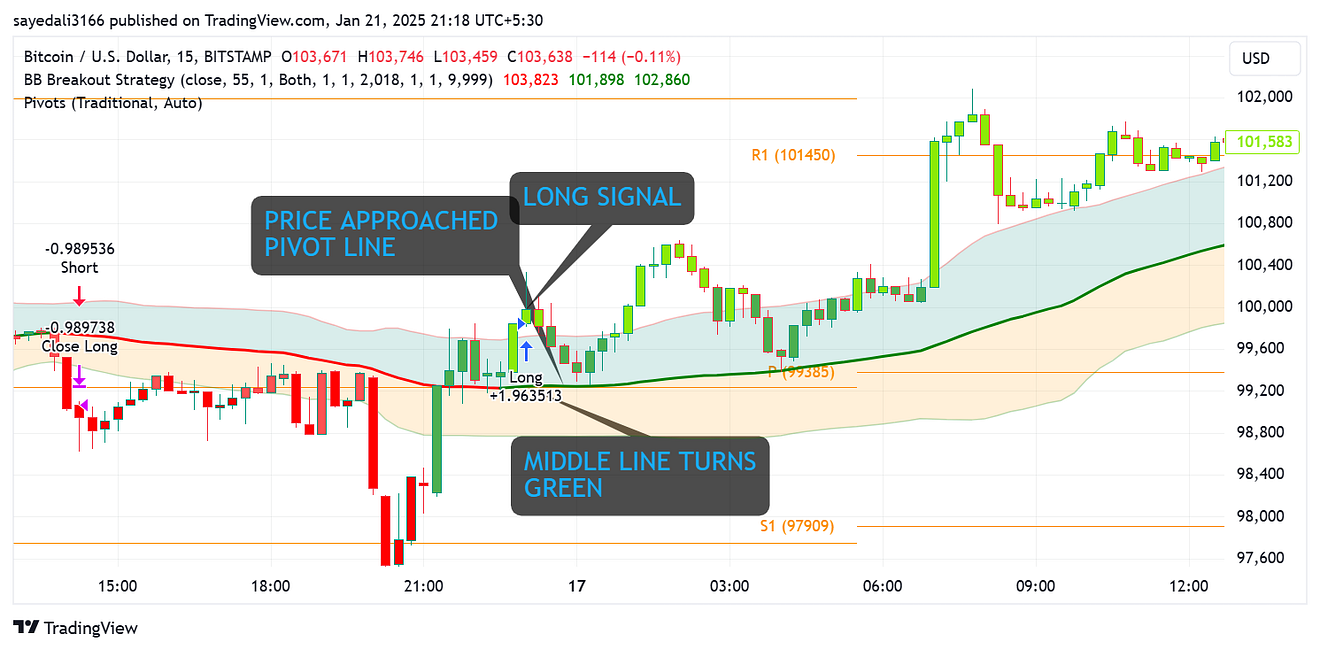

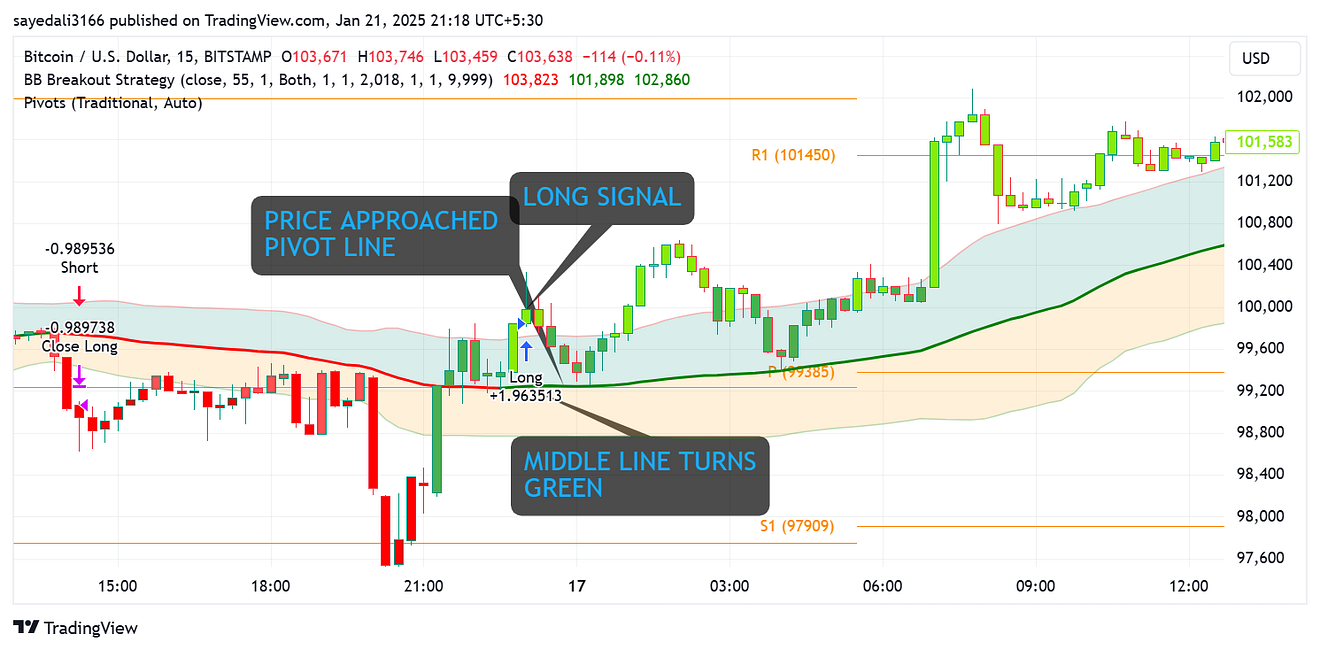

Buy Entry Conditions

- Bollinger Bands indicator gives a long signal.

- The middle line of the Bollinger Bands turns green.

- The market price moves above the middle line.

- Price is near or bouncing from a Pivot Point (S1, S2, or P), providing additional support.

- A green candle forms as final confirmation.

Stop Loss:

- Place below the lower band of the Bollinger Bands or the nearest pivot support (e.g., S1 or S2).

Take Profit:

- Use a risk-to-reward ratio of 1:1.5 or set targets near the next pivot resistance (e.g., R1 or R2).

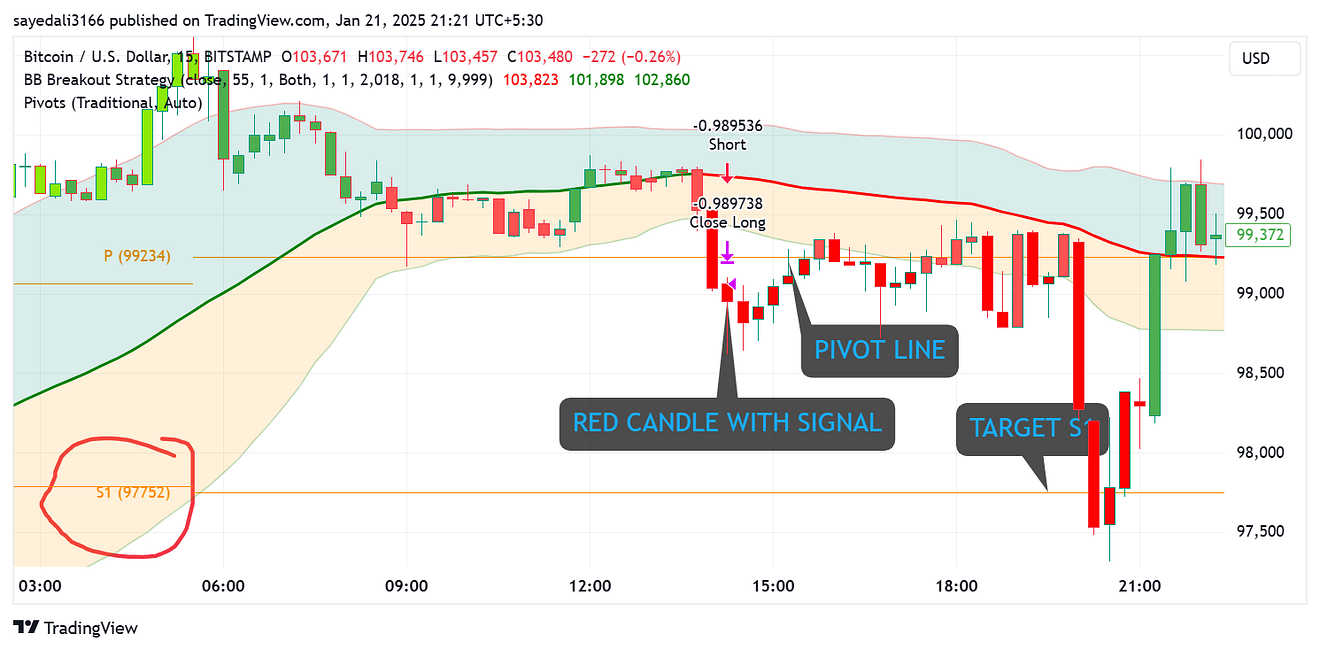

Sell Entry Conditions

- Bollinger Bands indicator gives a short signal.

- The middle line of the Bollinger Bands turns red.

- The market price moves below the middle line.

- The price is near or rejected from a Pivot Point (R1, R2, or P), providing resistance.

- A red candle forms as final confirmation.

Stop Loss:

- Place above the upper band of the Bollinger Bands or the nearest pivot resistance (e.g., R1 or R2).

Take Profit:

- Use a risk-to-reward ratio of 1:1.5 or set targets near the next pivot support (e.g., S1 or S2).

Key Points

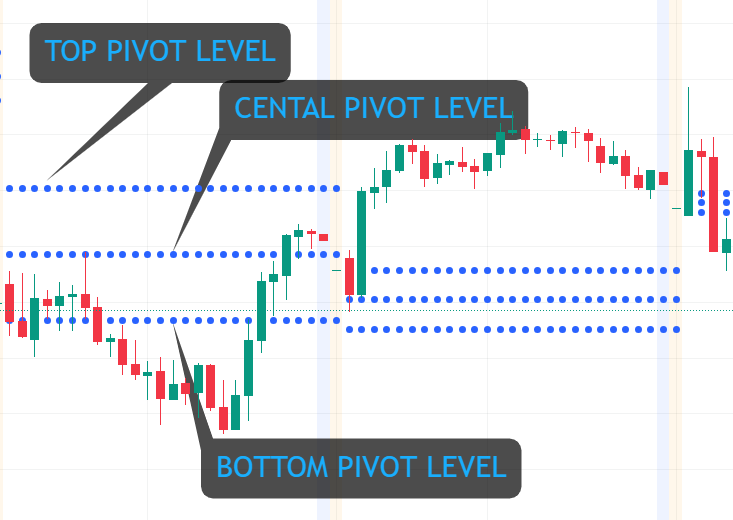

- Pivot Points act as dynamic levels of support and resistance, enhancing trade accuracy.

- Enter trades only when all indicators align for maximum probability.

- Use Bollinger Bands middle line and Pivot Points to identify key areas for stop loss and target placement.

Important Notes

- Pivot Points are crucial for identifying high-probability zones.

- Avoid trading during major news events, as volatility can disrupt indicator alignment.

- Backtest this strategy extensively before live trading to understand its nuances.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered as financial or trading advice. Trading in the stock market involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research and consult with a qualified financial advisor before making any trading decisions. The author is not responsible for any losses incurred as a result of using this strategy.

Expecting more articles